THE CARGILL FAMILY The Invisible Masters of Global Food Supply Anatomy of a $51 Billion Empire Controlling 25% of Agricultural Commodities

- I. Introduction: The Ghosts Who Feed 8 Billion Humans

- II. Minnesota Roots: William Wallace Cargill and the DNA of Productive Discretion

- III. Genesis of Global Empire: From Minnesota to Planetary Commodity Control

- IV. Architecture of Absolute Family Control: 159 Years Without Dilution

- V. The Art of Strategic Invisibility: Dominating Without Appearing

- VI. The Vertically Integrated Empire: From Gene to Plate via Geneva

- VII. Geneva: The Fiscal and Operational Hub of the Invisible Empire

- VIII. Mechanisms of Sectoral Domination

- IX. Food Geopolitics: The Invisible Weapon of American Influence

- X. Structural Vulnerabilities and Future Adaptations

- XI. Strategic Adaptations for Dynastic Survival

- XII. Conclusion: The Unsurpassable Blueprint for Modern Sectoral Domination

I. Introduction: The Ghosts Who Feed 8 Billion Humans

THE CARGILL FAMILY The Invisible Masters of Global Food Supply Anatomy of a $51 Billion Empire Controlling 25% of Agricultural Commodities. The Cargill-MacMillan dynasty represents the apex of invisible capitalist concentration. With $165 billion in annual revenues and a family fortune of $51 billion distributed among approximately 100 descendants, they have discreetly controlled 25% of global agricultural commodity trade for 159 years without ever raising a single dollar on public markets. This dynastic performance surpasses the financial Rothschilds, petroleum Rockefellers, or chemical Du Ponts in longevity and absolute sectoral control

Unlike other 19th-century industrial empires that sought visibility to dominate, the Cargills understood a fundamental truth: those who silently control food control humanity. Their genius lies in constructing a de facto monopoly over the entire global food chain—from seed to plate—while remaining perfectly invisible to the general public and regulators.

This strategic invisibility grants them pricing power over basic commodities that borders on legal market manipulation. When Cargill decides to accumulate or release wheat, corn, or soy stocks, global prices move. When they finance or cut credit to farmers, global production volumes fluctuate. This capacity to manipulate essential physical flows far exceeds the power of central banks over monetary flows.

II. Minnesota Roots: William Wallace Cargill and the DNA of Productive Discretion

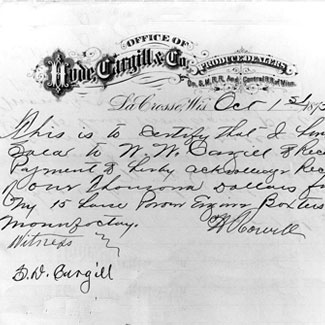

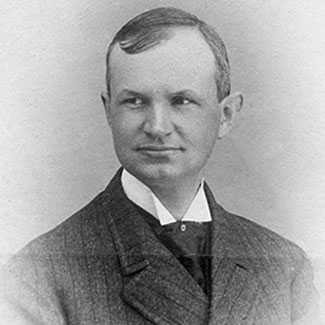

The empire began in 1865 when William Wallace Cargill, son of a Scottish farmer, purchased his first grain elevator in Conover, Iowa for $3,000 borrowed. Unlike other Gilded Age entrepreneurs who sought ostentation and public recognition, W.W. Cargill developed from the outset an obsession with operational invisibility and absolute vertical control of his value chain.

His revolutionary vision: understanding that in agriculture, information about harvests, stocks, and demand was worth more than land ownership itself. While railroad barons like Vanderbilt built visible and ostentatious empires, Cargill quietly constructed an agricultural information network that gave him permanent decisional advantage over all competitors.

In 1875, W.W. Cargill strategically relocated operations to La Crosse, Wisconsin, then Minneapolis, positioning the company at the geographic heart of the American Great Plains. This location was not accidental: it allowed control of grain flows from production zones to export ports, creating a mandatory tollgate on global food supply.

W.W. Cargill’s psychological legacy forged a unique family culture that endures 159 years later: absolute mistrust of external shareholders, obsession with total operational control, conviction that true wealth comes from discretion rather than ostentation, and understanding that controlling essential physical flows confers more power than controlling financial flows

III. Genesis of Global Empire: From Minnesota to Planetary Commodity Control

Cargill’s transformation into an invisible giant accelerated under John MacMillan Sr.’s leadership, who took control in 1912 after refinancing the company from near-bankruptcy. MacMillan Sr. revolutionized the industry by developing the first integrated international agricultural commodity trading system, establishing operational bases in Buenos Aires (1929), Geneva (1956), and London (1960).

This geographic expansion followed ruthless value extraction logic: Cargill implanted itself in every global production region not to serve local markets, but to control export flows to consumption zones and capture geographic arbitrage. In Argentina, they directly financed estancias in exchange for 20-year exclusivity contracts. In Brazil, they built port infrastructure necessary to evacuate soybeans to Asia. In Ukraine, they locked access to the most fertile lands via predatory financing arrangements.

International expansion accompanied aggressive vertical integration that systematically eliminated all intermediaries. In the 1940s-50s, Cargill acquired shipping companies, oil refineries, animal feed plants, and meat processing facilities. Each acquisition aimed to concentrate more value-added within the Cargill ecosystem and create insurmountable barriers to entry for competitors.

MacMillan’s key strategic innovation: understanding that in agro-food, controlling producer financing equals controlling production itself. Cargill Financial Services was born from this insight, creating a financial dependency system that transformed 40,000 “independent” farmers into captive subcontractors of the Cargill system.

IV. Architecture of Absolute Family Control: 159 Years Without Dilution

The Cargill control structure represents a masterpiece of dynastic engineering that has survived six generations, two world wars, the Great Depression, and all modern economic crises without ever diluting family control. The company has remained private for 159 years, owned 88% by approximately 100 direct descendants of the Cargill-MacMillan families via a complex network of perpetual trusts established in Minnesota and Delaware

Precise Ownership Structure:

- 88%: ~100 Cargill-MacMillan family members via family trusts

- 10%: Employee Stock Ownership Plan (ESOP)

- 2%: Non-family professional management

Decision-making power concentrates in a 6-member active Family Council controlling all major strategic decisions. Current leadership: David MacLennan (non-family CEO but loyal for 30 years), under tight supervision of Gregory Page (Chairman, MacMillan descendant) and James Cargill II (great-great-grandson of founder). This structure ensures strategic decisions remain in family hands while using professional management for operational execution.

Armored Succession Mechanism: The family succession system requires each heir to complete minimum 5-year training in operations before board access. Standardized typical training: Harvard Business School + mandatory rotation in international subsidiaries (Argentina, Brazil, Singapore, Geneva) + 2-year probationary period in operational division + loyalty test via increasing responsibilities. This generational discipline maintains operational competence while preserving absolute family loyalty.

Drastic Anti-Dilution Clauses: Corporate statutes include hermetic protections: no share sales to outsiders without absolute family unanimity, family preemption rights on all transactions, contractual obligation to reinvest 80% of dividends in expansion, and automatic forfeiture clauses for any member attempting external sales. These mechanisms ensure growth reinforces family control rather than diluting it.

Liquidity Management Without Dilution: The family has overcome several liquidity crises without ever losing control: 1992 (ESOP creation, 17% sale for $700M), 2004 (Mosaic Company creation for partial liquidity), 2011 (Mosaic stakes sale for $6B following Margaret Cargill’s death). Each crisis is resolved via sophisticated structures preserving family control while generating necessary liquidity.

V. The Art of Strategic Invisibility: Dominating Without Appearing

Cargill has elevated strategic invisibility to the level of economic warfare art. Unlike other publicly traded agro-food giants (Archer Daniels Midland, Tyson Foods, Unilever), Cargill has no legal transparency obligations. Their annual revenues of $165 billion and estimated profits of $4-6 billion are revealed only in minimalist 2-page press releases, without any detail by division, geography, or segment.

This opacity grants them decisive competitive advantage in commodity trading. Their public competitors must reveal positions, strategies, and quarterly performance to analysts and regulators. Cargill can discreetly accumulate massive positions on Ukrainian wheat or Brazilian soybeans without alerting markets, then unwind them at optimal timing without any external pressure from analysts or shareholders.

Systematic Media Erasure: The Cargill family has systematically avoided all personal media exposure for 159 years. No family member ever appears in Forbes or Bloomberg wealth rankings because their wealth is intentionally locked in complex family trusts making public valuation impossible. This invisibility protects them from political criticism about food industry concentration and antitrust regulatory pressure.

Cargill’s communication architecture limits itself to strict legal minimums: basic corporate website, laconic annual financial releases, and zero executive interviews in trade press. No family member ever participates in industry conferences, economic forums, or visible philanthropic events. This discretion intentionally contrasts with competitors’ aggressive marketing approach and reinforces their image of pure operational efficiency.

VI. The Vertically Integrated Empire: From Gene to Plate via Geneva

The Cargill empire extends across the entire global food chain via methodical vertical integration that eliminates all intermediaries and concentrates all value-added within the family ecosystem. This integration literally covers every stage from genetic research to final transformation.

Upstream – Production Control:

- Genetics: R&D partnerships with Monsanto/Bayer for optimized seed development

- Fertilizers: Operational ties maintained with Mosaic (spun-off 2004) for 13% global phosphate production

- Financing: Cargill Financial Services directly finances 40,000 farmers via $8 billion agricultural credit outstanding

- Production Contracts: Exclusivity commitments with producers linked to predatory financing

Mid-Chain – Logistics Infrastructure:

- Storage: 350 strategically distributed storage sites representing 15% of global grain storage capacity

- Transport: Integrated fleet including 650 river barges, 2,000 rail cars, maritime fleet via exclusive partnerships

- Ports: Port infrastructure investments in 15 countries to control export exit points

- Trading: Geneva, Singapore, Buenos Aires hubs for permanent geographic arbitrage

Downstream – Processing and Distribution:

- Slaughter: Cargill Meat Solutions slaughters 35,000 cattle/day, controls 22% US beef production

- Poultry: 25% US poultry market via integration contracts with 12,000 captive breeders

- Processing: Oil, sugar, cocoa, food ingredient plants in 40 countries

- Distribution: Direct sales to food multinationals and governments

VII. Geneva: The Fiscal and Operational Hub of the Invisible Empire

Cargill International SA: The Profit Optimization Machine

Since 1956, Geneva has served as European headquarters and fiscal optimization hub for the Cargill empire via Cargill International SA, company established in Grand-Lancy with commercial registry number CHE-105.550.610. This subsidiary employs 350 highly qualified people and centralizes 60% of the group’s global agricultural commodity trading, generating estimated annual turnover of $80-100 billion.

Geneva Operational Structure:

- Grain Trading: Global centralization of wheat, corn, soy, barley trading from Geneva

- Oilseed Trading: European hub for vegetable oils and meals

- Freight Trading: Global headquarters for maritime chartering and freight negotiation

- Shipping Operations: Maritime fleet coordination and commercial route optimization

- Risk Management: European center for hedging and commodity risk management

Swiss Tax Optimization: $400-600M Annual Savings

The Geneva structure methodically exploits international taxation differentials via perfectly legal but sophisticated mechanisms. Geneva offers an 8.1% corporate rate versus 21% in the United States and 25%+ in most European countries, generating estimated annual tax savings of $400-600 million for Cargill.

Transfer Pricing Mechanism: Global productive subsidiaries (Brazil, Argentina, Ukraine, United States) sell their commodities to Cargill International SA at optimized transfer prices that concentrate profits in Switzerland. Cargill International then resells to global final customers (Nestlé, Unilever, governments), capturing commercial margin in the low-tax jurisdiction. This optimization is reinforced by intellectual property licensing agreements that displace even more value-added to Switzerland.

Specific Swiss Tax Advantages:

- No capital gains tax for securities trading (versus 20-28% US/EU)

- 35% withholding tax but fully recoverable via tax returns

- Double taxation treaties with 100+ countries avoid double taxation

- Fiscal rulings possible for complex structures via Geneva Canton negotiation

- Legal stability and long-term fiscal predictability

VIII. Mechanisms of Sectoral Domination

Information Asymmetry: The Weapon of Mass Competition Destruction

Cargill invests $200 million annually in proprietary agricultural monitoring systems giving them permanent and decisive informational advantage over all competitors, governments, and international institutions. This informational infrastructure surpasses most states’ surveillance capabilities.

Global Surveillance Network:

- 15,000 meteorological sensors in global production zones with real-time data

- Proprietary satellites for crop condition surveillance and yield prediction

- AI algorithms predicting agricultural yields 6 months ahead with 85% accuracy

- Surveillance drones for crop monitoring in 25 countries

- Informant network in cooperatives, agriculture ministries, and global ports

This infrastructure allows them to know global crop conditions before producing governments themselves. When drought threatens Iowa corn, floods destroy Ukrainian wheat, or disease attacks Brazilian soybeans, Cargill adjusts positions 2-6 months before information becomes public. This anticipation generates estimated trading profits of $500 million – $1.2 billion annually.

Legal Price Manipulation via Information Asymmetry: Control of 25% of global agricultural commodities combined with exclusive information gives Cargill pricing power that borders on market manipulation but remains perfectly legal. Typical mechanism: anticipating poor Ukrainian wheat harvest (via proprietary monitoring), Cargill discreetly accumulates American and Canadian wheat stocks for 3-6 months before shortage becomes public. When prices explode, they progressively release stocks, capturing price differential without creating excessive volatility that would alert regulators.

Agricultural Financing Capture: Transforming Farmers into Subcontractors

Cargill Financial Services represents the most sophisticated and pernicious dimension of their sectoral control strategy. With $8 billion in agricultural loan outstanding across 40,000 farms in 15 countries, they have created a financial dependency system transforming theoretically “independent” farmers into totally dependent captive subcontractors of the Cargill ecosystem.

Financial Capture Mechanism: Predatory financing works thus: Cargill finances 70-80% of seed, fertilizer, equipment, and working capital costs in spring against contractual commitment to deliver 85-95% of harvest at price fixed at signing with 3-8% discount from anticipated spot market. This structure guarantees Cargill predictable supply at systematically below-market prices while transferring entire climate, phytosanitary, and price risks to the farmer.

Existential Dependency Cycle: For farmers, this financial dependency quickly becomes existential and impossible to break. Traditional banks require guarantees most family farms cannot provide (owned land, non-pledged equipment, stable cash flow). Cargill accepts future harvest as primary guarantee, creating dependency cycle where leaving the Cargill system means losing access to financing necessary to continue operations.

After 3-5 years in the Cargill system, farmers discover they are no longer independent entrepreneurs but de facto employees working on their own land for Cargill’s account. They no longer control their selling prices, input suppliers, commercial outlets, or even production methods dictated by Cargill contracts.

Systematic Regulatory Capture: Writing the Laws That Govern You

Cargill deploys a $15 million annual budget in direct US lobbying, plus $30-50 million via contributions to think tanks, industry associations, and university research programs that indirectly influence policy-making in three key dimensions: domestic agricultural regulation, international trade, and environment.

Industrial Revolving Door: At the US agricultural level, Cargill has placed 47 former employees in key positions at the Department of Agriculture, EPA, and Commerce Department since 2000. This revolving door guarantees new regulations are designed with intimate understanding of Cargill operations and systematically avoid disruptions to their business model. Concrete examples: regulations on GMOs, pesticides, and nutritional standards are drafted by former Cargill employees temporarily posted in federal agencies.

International Trade Influence: On international trade, Cargill directly influences trade agreement negotiations via their presence on USTR (US Trade Representative) advisory committees. They helped structure agricultural clauses of NAFTA, TPP, and USMCA to eliminate US export barriers while protecting their international investments via investment protection clauses.

Environmental Regulatory Capture: Facing growing pressure on intensive agriculture and climate change, Cargill massively funds ($50M+/year) research on “sustainable” agriculture and alternative proteins, controlling public narrative to avoid regulations impacting their core business. They fund university chairs, environmental think tanks, and NGOs promoting their solutions as alternatives to constraining regulations.

IX. Food Geopolitics: The Invisible Weapon of American Influence

Cargill operates de facto as an American soft power instrument disguised as a private company. Their control of 25% of global agricultural exports and associated logistics infrastructure serves Washington’s geopolitical objectives while generating colossal private profits. This weaponization of agriculture confers immense diplomatic leverage on the United States, particularly in regions dependent on food imports (Africa, Middle East, Southeast Asia).

Case Study: Ukraine War as Profit Opportunity The Ukraine war perfectly illustrates this geopolitical instrumentalization of agriculture. Before Russian invasion, Cargill controlled 30% of Ukrainian grain exports via long-term contracts with local producers and $500M investments in Odessa and Mykolaiv port infrastructure. When war blocked Ukrainian exports, Cargill immediately redirected supply from their American and South American stocks, capturing exceptional profits of $2.3+ billion in 2022 while serving Western geopolitical objectives of economic pressure on Russia.

Controlled Famine Weapon: This capacity to create or resolve food shortages in entire regions confers on Cargill (and by extension the United States) geopolitical power exceeding that of many conventional armies. They can starve a hostile country by cutting supplies or save an ally by redirecting flows. This weaponization of agriculture remains invisible because it operates via apparently neutral “market mechanisms.”

Political Protection via Geostrategic Utility: This geopolitical instrumentalization reinforces Cargill’s position in the American political ecosystem. They are not just a private company maximizing profits, but a national strategic asset in competition with China and Russia for global influence. This geopolitical dimension guarantees total political protection against potential antitrust attempts or excessive regulation.

X. Structural Vulnerabilities and Future Adaptations

Despite their historic dominant position, Cargill faces several structural vulnerabilities that could threaten their empire long-term if not managed with the same sophistication as their past successes.

Generational Dilution: The first vulnerability concerns generational succession: the family enters its 6th generation with over 100 descendants scattered geographically and culturally. Maintaining family discipline, interest alignment, and loyalty to the dynastic project becomes exponentially more difficult each generation. Risks include succession disputes, members wanting to liquidate participations, or progressive dilution of entrepreneurial family culture in favor of rentier mentality.

Concentrated Climate Exposure: The second major vulnerability comes from geographic concentration of their productive investments in zones increasingly exposed to climate change. Their massive assets in American Great Plains, Argentine Pampa, and Ukrainian plains suffer growing water stress, more frequent extreme weather events, and changing precipitation patterns that could compromise future yields. Cargill invests $500M+ annually in adaptation technologies but remains structurally exposed to major climate disruptions.

Food Technology Disruption: The third vulnerability concerns accelerating evolution of food preferences and production technologies toward alternative proteins (plant-based, lab-grown meat, insect protein) that could progressively disrupt their business model based on intensive livestock and feed crops. Cargill has anticipated this transition by investing $300M in alternative protein startups since 2018, but their traditional assets (slaughterhouses, feedlots, crushing plants) still represent 40%+ of their valuation and could become stranded assets.

Regulatory and Antitrust Pressure: The invisibility that has been their strength could become a vulnerability facing rising antitrust and regulatory pressure in key jurisdictions. Governments and public opinion are progressively becoming aware of excessive food industry concentration and excessive pricing power exercised by Cargill. Antitrust investigations are underway in the EU and could extend to the United States if administration changes.

XI. Strategic Adaptations for Dynastic Survival

Facing these challenges, Cargill deploys a four-axis adaptation strategy aimed at preserving their domination while adapting to new economic and technological paradigms.

Aggressive Geographic Diversification: Expansion toward Sub-Saharan Africa and Southeast Asia aims to reduce dependence on traditional zones exposed to climate change. Massive investments in Nigeria, Ghana, Vietnam, and Indonesia to develop new production zones and create new logistics hubs. This diversification also positions them in future demographic growth zones where food demand will explode.

Technology Leapfrog via Ventures: $1B+ investments in disruptive agricultural technologies: vertical farming, precision agriculture, advanced genetic engineering, and agricultural automation. The objective is maintaining competitive advantage by adopting technologies that will revolutionize agriculture before competitors. Their venture arms invest in 200+ agtech startups to identify and capture disruptive innovations.

Portfolio Transition toward Food Innovation: Progressive diversification toward alternative proteins, functional foods, and personalized nutrition to anticipate evolving food preferences. Acquisitions and partnerships in plant-based protein, precision fermentation, and cellular agriculture. The objective is maintaining dominant position regardless of nutritional substrates used.

Defensive Regulatory Strategy: Reinforcement of their regulatory capture via increased investments in preventive lobbying, strategic philanthropy, and academic influence. Creation of foundations and think tanks to shape public narrative on agriculture and food. Preventive placement of alumni in global regulatory institutions.

XII. Conclusion: The Unsurpassable Blueprint for Modern Sectoral Domination

The Cargill empire demonstrates that it remains possible in the 21st century to build and maintain quasi-monopolistic sectoral domination via disciplined family control, methodical vertical integration, and sophisticated optimization of corporate, fiscal, and regulatory structures. Their success rests on five fundamental pillars reproducible by other family offices in other critical sectors.

Pillar 1: Hermetic Family Control Without Dilution Maintaining absolute family control via sophisticated trust structures eliminating all risk of external dilution, hostile takeover, or external shareholder pressure. This architecture guarantees long-term strategic coherence impossible in public structures subject to quarterly market pressures. Generational discipline and mandatory heir training maintains competence while preserving family loyalty.

Pillar 2: Total Vertical Integration of Essential Sector Integration of the entire value chain of a critical sector, from primary production to final consumption, eliminating all intermediaries and concentrating total value-added within the family ecosystem. This approach transforms “partners” into captive subcontractors and creates quasi-insurmountable barriers to entry for competitors.

Pillar 3: Systematic Information Asymmetry Massive investments in data, intelligence, and monitoring technologies conferring permanent decisional advantage over all other market participants. In the modern information economy, those who know first capture value. This asymmetry enables legal price manipulation via optimal intervention timing.

Pillar 4: Global Fiscal and Regulatory Optimization Optimized geographic presence methodically exploiting taxation differentials and regulatory gaps between jurisdictions. Using offshore trading hubs (Geneva, Singapore, Dublin) to concentrate profits in low-tax jurisdictions can represent 15-20% profitability improvement. Systematic regulatory capture ensures laws are written to protect and reinforce dominant position.

Pillar 5: Strategic Invisibility as Competitive Advantage Systematic avoidance of all media or public exposure protecting against political and social pressure while maintaining maximum freedom of action. In a world of media over-exposure and increased regulatory surveillance, discretion becomes decisive competitive advantage enabling operation without external constraints.

Application Sectors for Family Offices: The Cargill model offers a reproducible template in other fragmented but critical sectors where disciplined vertical integration can create durable stranglehold on an indispensable link in the modern economy:

- Water Infrastructure: Utilities + treatment + distribution + storage

- Waste Management: Collection + processing + recycling + disposal

- Logistics/Supply Chain: Warehousing + transport + last-mile + tracking

- Healthcare Infrastructure: Hospitals + pharma distribution + insurance + data

- Energy Storage: Batteries + grid storage + charging infrastructure + raw materials

The Ultimate Lesson for UHNWIs: Cargill demonstrates that in the modern economy, controlling essential PHYSICAL FLOWS confers more durable power than controlling financial flows. Banks can be regulated, hedge funds can be copied, tech companies can be disrupted, but those who control what people eat, drink, or breathe control humanity itself.

The Cargill empire remains the unsurpassable blueprint for any family aspiring to durable sectoral domination in a perpetually evolving world. Their 159-year success without interruption proves that implacable family discipline combined with strategic sophistication can create quasi-immortal empires even in the modern hyper-volatile economy