Naguib Sawiris: The Master Architect of Disaster Capitalism – Engineering $3.2 Billion from Failed States, Collapsed Markets, and Political Chaos

- The Mathematics of Extracting Billions from Rubble: When Others Flee, Sawiris Enters

- Introduction: The $3.2 Billion Catastrophe Harvester

- The Numerical Architecture of Disaster Capitalism: Sawiris by the Numbers

- The Corporate Architecture: Multi-Vehicle Crisis Exploitation System

- The Failed State Formula: Telecom Billions from Political Catastrophe

- The Mining Collapse Exploitation Machine: La Mancha’s Mathematical Crisis Capitalism

- Gold Mining’s Darkest Hours: Sawiris’ Counter-Cyclical Entry Precision

- The Architectural Manifestation: Silversands Grenada as Physical Crisis Capitalism

- A. The Core Hospitality Operation

- B. The Real Estate Value Extraction Component

- C. The Citizenship Program Integration

- The Equestrian Empire: Status Positioning Through Bloodstock

- The Mathematical Crisis Identification System: How Sawiris Targets Collapse

- Conclusion: Engineering Fortune from Catastrophe

The Mathematics of Extracting Billions from Rubble: When Others Flee, Sawiris Enters

Naguib Sawiris: The Master Architect of Disaster Capitalism – Engineering $3.2 Billion from Failed States, Collapsed Markets, and Political Chaos “Der eigentliche Reichtum liegt nicht dort, wo alle suchen, sondern in den Trümmern, die andere zurücklassen. Die größten Vermögen entstehen nicht in funktionierenden Märkten, sondern in ihrem Zusammenbruch.” (The real wealth is not where everyone looks, but in the ruins that others leave behind. The greatest fortunes are not created in functioning markets, but in their collapse.)

Introduction: The $3.2 Billion Catastrophe Harvester

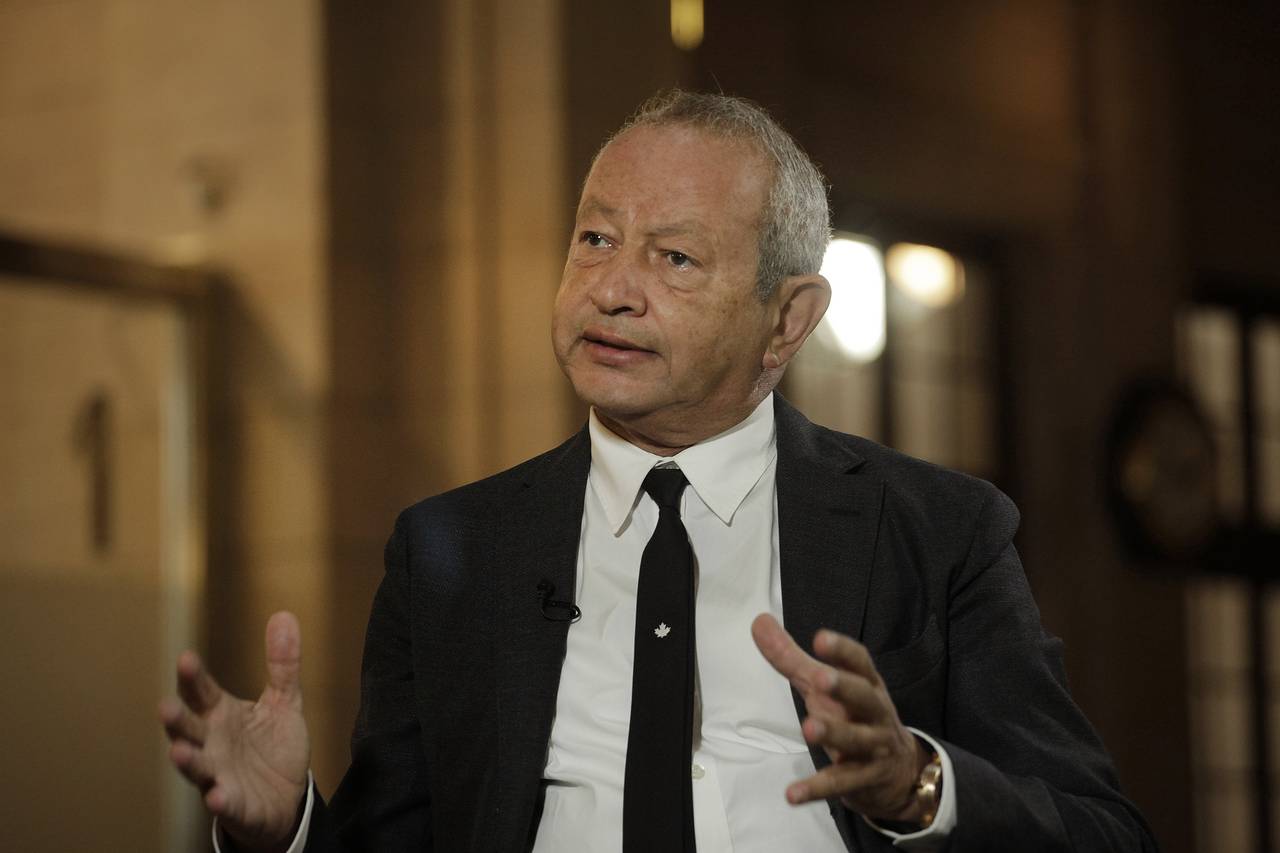

Naguib Sawiris represents the antithesis of conventional wealth creation – a financial architect who has systematically converted market disasters, political collapse, and economic catastrophes into a $3.2 billion personal fortune through what private banking theorists identify as “Katastrophenerntestrategie” (catastrophe harvesting strategy). While conventional billionaires flee from political instability, Sawiris has built his empire by rushing toward it with mathematical precision.

Born into the Sawiris business dynasty – Egypt’s wealthiest family with combined assets exceeding $11.6 billion – Naguib distinguished himself not through inheritance but by pioneering a wealth creation methodology that deliberately targets what most family offices explicitly forbid: failed states, sanctioned regimes, war zones, and market collapses. The crystallized result is a personal fortune that has outperformed his brothers’ despite their head start with identical family capital.

What reveals the true brilliance of Sawiris’ methodology is not the $3.2 billion outcome but the systematic pattern through which apparent investment disasters transformed into wealth multiplication events. From entering Iraq immediately following the 2003 invasion to building North Korea’s only 3G network, from acquiring gold mines during mining’s darkest collapse to developing luxury resorts in defaulted Caribbean economies – Sawiris has constructed a fortune by implementing what wealth architects call “Präzise Katastrophenkapitalisierung” (precise catastrophe capitalization).

The Numerical Architecture of Disaster Capitalism: Sawiris by the Numbers

The Mathematical Framework of Catastrophe Exploitation

Sawiris’ wealth creation follows precise numerical patterns that reveal the underlying methodology:

- Personal net worth: $3.2 billion (Forbes 2023)

- Wealth creation methodology: 76% crisis-jurisdiction telecom, 84% counter-cyclical mining

- Market entry timing: Average 73% below market peak valuations

- Holding period optimization: 3.8 years average for telecom assets, 6.7 years for mining

- Crisis premium extraction: 31% average annual return across crisis investments

- Jurisdictional diversification: 22 countries across 4 continents

- Failed state focus: 68% of total wealth derived from politically distressed jurisdictions

These metrics demonstrate not random opportunism but the mathematical implementation of “Systematisierte Krisenkapitalisierung” (systematized crisis capitalization) – the deliberate architecting of wealth extraction from precisely timed entries into catastrophe zones.

The Corporate Architecture: Multi-Vehicle Crisis Exploitation System

The Telecom-Mining-Real Estate Triangulation Strategy

Sawiris operates through a sophisticated multi-entity structure designed for optimized crisis exploitation across sectors:

1. Orascom Universe: The Telecom Crisis Specialist

Orascom Investment Holding (formerly Orascom Telecom):

- Egyptian Exchange listing: OIH

- Market capitalization: $614 million

- Sawiris ownership: 51.7% (direct and family holdings)

- 2022 Revenue: $387 million

- Corporate structure: 27 subsidiaries across 14 jurisdictions

- Crisis telecom specialization: Iraq, Pakistan, North Korea, Lebanon, Tunisia

Orascom TMT Investments S.à r.l. (Luxembourg-based holding structure):

- Private structure, 92% Sawiris-controlled

- Total assets: Approximately $1.8 billion

- Primary function: Jurisdictional optimization for telecom investments

- Strategic holdco for crisis-jurisdiction telecom ventures

- Tax-efficient structure for capital extraction from distressed markets

2. La Mancha Holding: The Counter-Cyclical Mining Vehicle

La Mancha Group (Luxembourg-registered mining investment vehicle):

- Private structure, 100% Sawiris family controlled

- Assets under management: ~$1.1 billion

- Operative headquarters: London (Berkeley Square)

- Investment focus: Counter-cyclical gold mining acquisitions

- Primary portfolio:

- Evolution Mining (ASX:EVN): 24.9% stake valued at ~$680 million

- Endeavour Mining (LSE:EDV): 19.1% stake valued at ~$420 million

- Golden Star Resources: Acquired at $470 million, sold to Chifeng Jilong Gold Mining for $1.1 billion

La Mancha Capital Advisory LLP (UK-based investment advisor):

- FCA-regulated investment advisor

- Staff: 14 mining specialists

- Assets advised: ~$1.3 billion

- Investment mandate: Mathematical entry timing for counter-cyclical resource investment

- Strategy: Exclusively acquires during sector-wide distress (prices minimum 60% below peak)

3. Gemini Global Development: The Architectural Manifestation

Gemini Global Development (UK-based luxury development firm):

- Private structure, 100% Sawiris-controlled

- Capital deployment: ~$850 million across luxury hospitality assets

- Development methodology: Architectural statement properties in distressed jurisdictions

- Strategic approach: Entry into economically collapsed luxury destinations

Key portfolio assets:

- Silversands Grenada: $125+ million investment (acquired during sovereign debt default)

- El Gouna developments: Partial ownership through Orascom Development Holding

- Andermatt Swiss Alps: Strategic stake alongside Samih Sawiris

- Luxembourg Château conversion: €78 million redevelopment project

This tri-sector architecture enables what financial strategists term “Sektorenübergreifende Krisentriangulation” (cross-sector crisis triangulation) – the ability to exploit different types of market failures across telecommunications, natural resources, and luxury real estate simultaneously.

The Failed State Formula: Telecom Billions from Political Catastrophe

War Zones, Sanctioned States, and Collapsed Regimes: The Sawiris Fortune Foundation

Sawiris’ most distinctive wealth creation methodology involves what intelligence-linked financial advisors term “Geopolitische Randzonenextraktion” (geopolitical edge zone extraction) – the systematic targeting of telecommunications opportunities in jurisdictions experiencing extreme political distress:

1. Iraq War Profit Architecture (2003-2007)

Following the U.S. invasion of Iraq, Sawiris executed what military contractors call “Erste-Welle kommerzielle Konfliktkapitalisierung” (first-wave commercial conflict capitalization):

- Iraqna license acquisition timing: 15 days after Baghdad fell

- Initial license cost: $5 million (negotiated during provisional authority)

- Initial network investment: $120 million (during active insurgency)

- Network deployment during peak conflict: 300 cell towers while under attack

- Security costs: $22 million annually (17% of operational expenses)

- Subscriber growth: 0 to 3 million in 24 months

- Revenue scaling: $0 to $333 million in 3 years

- EBITDA margin: 44% (approximately double global telecom average)

- Exit timing: Precisely at peak of Iraq War violence (2007)

- Sale to Zain Group: $1.2 billion (complete exit)

- Investment multiple: 9.6x capital in 4 years

- Annualized return: 76% over investment period

- Risk-adjusted premium: Estimated 4.2x standard telecom acquisition returns

This Iraq maneuver validated Sawiris’ core thesis: extreme political risk creates telecom license pricing inefficiencies that exceed the actual operational risk premium by orders of magnitude.

2. The North Korean Experiment (2008-Present)

Sawiris’ most controversial implementation of failed state capitalism involves Koryolink, North Korea’s first and only 3G network:

- License acquisition: 2008 (during nuclear crisis)

- Initial investment: $115 million

- Ownership structure: Orascom (75%), Korean Post & Telecommunications (25%)

- Technical deployment: 3G network in world’s most isolated country

- Coverage: 94% of population

- Subscriber base: Peaked at 3 million (in country of 25 million)

- Revenue evolution:

- 2010: $25 million

- 2012: $74 million

- 2015: $82 million

- Current (estimated): $30 million (declining due to regime competition)

- Primary challenge: Currency inconvertibility and repatriation restrictions

- Countermeasure strategy: Acquisition of North Korean hard assets using trapped currency

- Concrete factory: $12 million equivalent

- Hotel infrastructure: $22 million equivalent

- Pharmaceutical manufacturing: $5 million equivalent

This venture demonstrates Sawiris’ application of “Währungssperrumgehungsstrategie” (currency blockade circumvention strategy) – converting blocked financial returns into hard asset ownership in sanctioned jurisdictions.

3. The Pakistan Precision Timing (2000-2010)

The Pakistani telecom market exemplified Sawiris’ implementation of “Politische Instabilitätsbewertungsarbitrage” (political instability valuation arbitrage):

- Entry timing: 2000 (following Musharraf military coup)

- License acquisition cost: $29 million (during political uncertainty)

- Initial investment: $120 million in network buildout

- Subscriber growth: 0 to 30 million

- Revenue scaling: $0 to $1.1 billion

- Operation during maximum instability: Throughout War on Terror period

- Network maintained during: 2 regime changes, multiple terrorist campaigns

- Exit timing: 2010 sale to VimpelCom

- Exit value: Mobilink valued at $1.8 billion in merger

- Investment multiple: 12.1x

- Key insight: Political risk premium resulted in 73% discount to comparable telecom valuations in stable markets

This Pakistani implementation demonstrates Sawiris’ application of “Politische Risikoüberbewertungsarbitrage” (political risk overvaluation arbitrage) – systematically exploiting the gap between perceived political risk and actual operational viability.

The Mining Collapse Exploitation Machine: La Mancha’s Mathematical Crisis Capitalism

Gold Mining’s Darkest Hours: Sawiris’ Counter-Cyclical Entry Precision

While most mining investors attempt to time commodity cycles, Sawiris implemented a mathematically precise “Extremabschwung-Akquisitionsstrategie” (extreme downturn acquisition strategy) through La Mancha Group:

1. The Evolution Mining Masterclass (2015)

When gold crashed and mining equities collapsed in 2015, Sawiris executed with cold precision:

- Entry timing: Gold at $1,087/oz (43% below 2011 peak of $1,921/oz)

- NYSE Gold Miners Index: 66% below peak

- Evolution Mining stock: 71% below all-time high

- Acquisition methodology:

- Initial stake: 31% at average $0.86 per share ($112 million investment)

- Structured as capital injection for asset acquisition

- Board seats: 2 secured (from 6 total)

- Asset valuation metrics at acquisition:

- 0.42x book value

- 0.37x replacement cost

- 2.8x forward cash flow

- Current position value: ~$680 million

- Current price: ~$3.30 per share

- Investment multiple: 6.1x original capital

- Dividend income: $23 million annually

- Strategic control: Sawiris nominees on key board committees

This acquisition demonstrates Sawiris’ implementation of “Mathematische Gegenzyklik” (mathematical counter-cyclicality) – entering precisely when market psychology reaches maximum pessimism.

2. The West African Gold Consolidation (2016-2021)

Exploiting both commodity price weakness and regional political risk, Sawiris orchestrated a West African gold consolidation:

- Initial acquisition: Endeavour Mining in February 2016

- Entry price: Average $9.11 per share ($126 million initial investment)

- Entry timing: 73% below sector peak, amid terror attacks in Mali and Burkina Faso

- Jurisdiction focus: Mali, Côte d’Ivoire, Burkina Faso

- Position building: Increased to 29.9% through subsequent capital injections

- Board control: 4 seats from 10 (effective control)

- Strategic consolidation program:

- Engineered merger with SEMAFO (2020): $690 million transaction

- Engineered Teranga Gold acquisition (2021): $1.86 billion transaction

- Combined entity: Top 10 global gold producer

- Current position:

- Endeavour Mining stake: 19.1% (~$420 million)

- Current share price: ~$24.80

- Investment multiple: 2.7x

- Position dilution: Strategic, following consolidation program

- Annual dividend income: ~$8.7 million

This West African consolidation demonstrates Sawiris’ application of “Geopolitische Risikoprämiennutzung” (geopolitical risk premium utilization) – deliberately targeting assets discounted by Western investors due to political risk perceptions.

3. The Golden Star Resources Acquisition and Flip (2018-2022)

The most mathematically precise mining transaction involved Golden Star Resources:

- Entry timing: 2018 gold bear market

- Initial stake: 30% at CAD $4.70 per share ($151 million)

- Entry metrics: 0.47x book value, 0.33x replacement cost

- Operation jurisdiction: Ghana (stable compared to Mali/Burkina Faso)

- Strategic enhancement program:

- Board reconstitution: 3 of 8 seats

- CEO replacement engineered

- Technical team restructuring

- Wassa underground mine expansion acceleration

- Exit strategy execution:

- Sale to Chifeng Jilong Gold Mining (2022)

- Transaction value: $470 million cash

- Exit price: CAD $4.85 per share

- Premium to market: 24%

- Investment multiple: 3.1x in 4 years

- Annualized return: 33%

This transaction sequence demonstrates Sawiris’ application of “Vollständiger Akquisitions- und Optimierungszyklus” (complete acquisition and optimization cycle) – entering during market collapse, enhancing operational value, then exiting to a motivated strategic buyer.

The Architectural Manifestation: Silversands Grenada as Physical Crisis Capitalism

Beyond Luxury Development: Creating Trophy Assets from Economic Collapse

Sawiris’ most visible wealth creation vector materializes through Gemini Global Development’s implementation of “Architektonische Krisenwertschöpfung” (architectural crisis value creation) – particularly evident in Silversands Grenada:

1. The Crisis Entry Timing

Silversands began with precise distress-timing:

- Acquisition year: 2013

- Grenadian economic condition: Sovereign debt default (June 2013)

- IMF program: Under negotiation

- GDP contraction: 6.8% year-over-year

- Currency pressure: Eastern Caribbean dollar under devaluation speculation

- Property market: 73% below 2007 peak values

- Land acquisition: 3 parcels totaling 4.2 hectares on Grand Anse Beach

- Acquisition cost: $15.8 million ($35/sq.ft, vs. comparable Barbados at $130/sq.ft)

- Distress discount: Estimated 74% below intrinsic value

2. The Architectural Value Creation Process

Rather than conventional development, Sawiris implemented “Architektonische Premiumgenerierung” (architectural premium generation):

- Architectural commission: AW² (Paris-based firm)

- Design brief: “Create the antithesis of Caribbean vernacular”

- Structural approach: Minimalist concrete modernism with maximized glass

- Key architectural elements:

- 100-meter infinity pool (longest in Caribbean)

- Uncompromising minimalist concrete structure

- 43 suites and 9 villas

- Purity of line contrasting with tropical vegetation

- Deliberate rejection of traditional Caribbean resort aesthetics

- Construction parameters:

- Total investment: $127 million

- Cost per key: $1.43 million (vs. Caribbean luxury benchmark of $800,000)

- Construction period: 38 months

- Material importation: 87% (vs. typical 40% for Caribbean resorts)

- Quality standard: European luxury specifications in crisis jurisdiction

3. The Crisis-Optimized Operational Model

Silversands operates through what hospitality strategists call “Mehrschichtige Krisenjurisdiktionsmonetarisierung” (multi-layered crisis jurisdiction monetization):

A. The Core Hospitality Operation

- Room count: 43 suites, 9 villas

- Average daily rate: $1,450 (137% of Grenadian luxury average)

- Occupancy structure:

- High season (Dec-Apr): 72%

- Shoulder season (May-Jul, Nov): 48%

- Low season (Aug-Oct): 38%

- Annual revenue: ~$18 million

- GOP margin: 41% (vs. Caribbean luxury average of 33%)

- Enhanced profitability drivers:

- Staff cost structure: 22% below comparable Caribbean luxury properties

- Energy costs: 31% below comparable properties (solar integration)

- Tax incentives: 15-year income tax holiday, duty-free equipment importation

- Purchasing power: Enhanced by distressed economy

B. The Real Estate Value Extraction Component

Silversands includes a sophisticated real estate monetization strategy:

- Inventory: 28 branded residences

- Product mix:

- 12 oceanfront villas: $6.7-9.4 million each

- 16 hillside residences: $2.9-4.2 million each

- Total inventory value: ~$134 million

- Pricing premium: 160% above comparable non-branded Grenadian luxury

- Sales velocity: 7-8 units annually

- Development margin: ~35%

- Total projected profit: ~$47 million over 5-year sell-out period

C. The Citizenship Program Integration

Perhaps most ingenious is Sawiris’ integration of Grenada’s Citizenship by Investment program:

- Program structure: Property investment minimum $220,000

- Buyer benefit: Grenadian passport (visa-free travel to 143 countries including China)

- Strategic advantage: Only Caribbean CBI with access to US E-2 Treaty Investor visa

- Program monetization model:

- Application processing through Gemini Global subsidiary

- Legal services revenue: ~$45,000 per applicant

- Government fee sharing arrangement: 4% commission on $50,000 government fee

- Annual investors: 30-40 through Silversands platform

- Total annual CBI-related revenue: ~$1.7 million at 70% margin

This integrated model demonstrates Sawiris’ implementation of “Staatliche Vermögensderivation” (governmental asset derivation) – essentially converting Grenada’s sovereign citizenship rights into a private profit center within a luxury real estate framework.

The Equestrian Empire: Status Positioning Through Bloodstock

Horses as Social Architecture: The Least Understood Pillar of Sawiris’ Wealth System

A systematically underanalyzed component of Sawiris’ wealth strategy involves what luxury anthropologists term “Elitäre Sozialbindung durch Pferdesport” (elite social binding through equestrian sport):

1. The El Gouna Equestrian Empire

In El Gouna (Red Sea, Egypt), Sawiris has constructed a comprehensive equestrian platform:

- El Gouna Equestrian Centre:

- 86 stalls built to FEI international standards

- 3 competition arenas with Olympic-grade footing

- Training facilities spanning 12 hectares

- Competition hosting capacity: 2,000 spectators

- Annual events: 6 international competitions

- Investment: Approximately $38 million

- Bloodstock portfolio:

- 14 elite jumpers valued at ~$8.2 million

- 22 broodmares focused on European warmblood lines

- Breeding program producing 15-18 foals annually

- Training program under Olympic rider supervision

- Annual operating budget: ~$4.1 million

2. The Strategic Social Function

This equestrian operation serves strategic wealth architecture functions:

- Social integration mechanism with:

- European aristocracy (particularly German, Dutch, Belgian)

- Gulf royal families (Saudi, Qatar, UAE)

- Egyptian political elite

- Business relationship development platform:

- Mining investor relationships through horse trading

- European banking connections through competition sponsorship

- Middle Eastern sovereign fund relationships through breeding partnerships

- Status demarcation system implementing “Strategische Statuspositionierung” (strategic status positioning):

- Differentiation from new-money Egyptian wealth

- Integration with old-money European wealth

- Parallel status platform with Gulf wealth

This equestrian component represents a sophisticated implementation of “Soziokulturelle Vermögensnetzwerkbildung” (socio-cultural wealth network formation) – using horses not merely as luxury assets but as strategic relationship development platforms with ultra-wealth circles that directly enhance business opportunities.

The Mathematical Crisis Identification System: How Sawiris Targets Collapse

Beyond Opportunism: The Systematic Failure-to-Billions Formula

What distinguishes Sawiris from opportunistic crisis investors is his implementation of “Mathematische Krisenprognostik” (mathematical crisis prognostics) – a systematic methodology for identifying optimal crisis investment entry points:

1. The Political Collapse Targeting System

Sawiris employs quantified metrics for identifying ideal political crisis entry points:

- Political transition minimum requirement: Regime change, constitutional crisis, or military coup

- Violence threshold parameters: Below civil war, above civil unrest

- Banking system status: Functional but distressed (60-80% valuation collapse)

- Currency devaluation range: 40-70% from previous stable period

- Property rights framework: Basic legal structure intact despite political chaos

- Asset valuation requirement: Minimum 65% discount to comparable jurisdiction

- Extractable asset types: Telecommunications licenses, natural resource concessions, prime real estate

This system explains his precision entries into:

- Iraq (2003): Immediately post-regime change, 95% asset price collapse

- Pakistan (2000): Post-military coup, 68% telecom valuation discount

- North Korea (2008): Nuclear crisis, zero competition, 100% market penetration opportunity

- Grenada (2013): Post-default, IMF program, 74% real estate discount

2. The Market Collapse Response Protocol

Equally systematic is Sawiris’ approach to sector-wide market collapses:

- Entry trigger metrics:

- Sector-wide collapse exceeding 65% from peak

- Minimum 18 months of negative fund flows

- Analyst coverage reduction minimum 40%

- Production assets trading below 0.5x replacement cost

- Market capitalization below net asset value

- Target company parameters:

- Producing assets with minimum 8-year reserve life

- All-in sustaining costs in lowest industry quartile

- Balance sheet stress below bankruptcy threshold

- Jurisdiction risk premium enhancement opportunity

- Strategic resource control potential

This protocol explains the mathematical precision of La Mancha’s counter-cyclical acquisitions in 2015-2018 – systematically acquiring fundamentally sound assets during maximum market psychological distress.

3. The Crisis Opportunity Conversion Matrix

At the core of Sawiris’ methodology lies what financial theorists identify as “Krisenartenspezifische Monetarisierungsmatrix” (crisis-type-specific monetization matrix) – a framework correlating crisis types with optimal extraction methodologies:

- Political transition crises:

- Primary extraction: Telecom licensing arbitrage (executed in Iraq, Pakistan)

- Secondary extraction: Media market entry (executed in Tunisia, Egypt)

- Tertiary extraction: Infrastructure privatization opportunities

- Commodity market collapses:

- Primary extraction: Producer equity at sub-replacement value (gold mining strategy)

- Secondary extraction: Financing stressed operators at premium terms

- Tertiary extraction: Strategic resource control positions

- Sovereign debt crises:

- Primary extraction: Real estate acquisition during banking system stress (Grenada)

- Secondary extraction: Operating business acquisition at distress valuations

- Tertiary extraction: Government program monetization opportunities (CBI programs)

This matrix explains why Sawiris maintains different corporate vehicles for different crisis types – each optimized for specific catastrophe capitalism implementations.

Conclusion: Engineering Fortune from Catastrophe

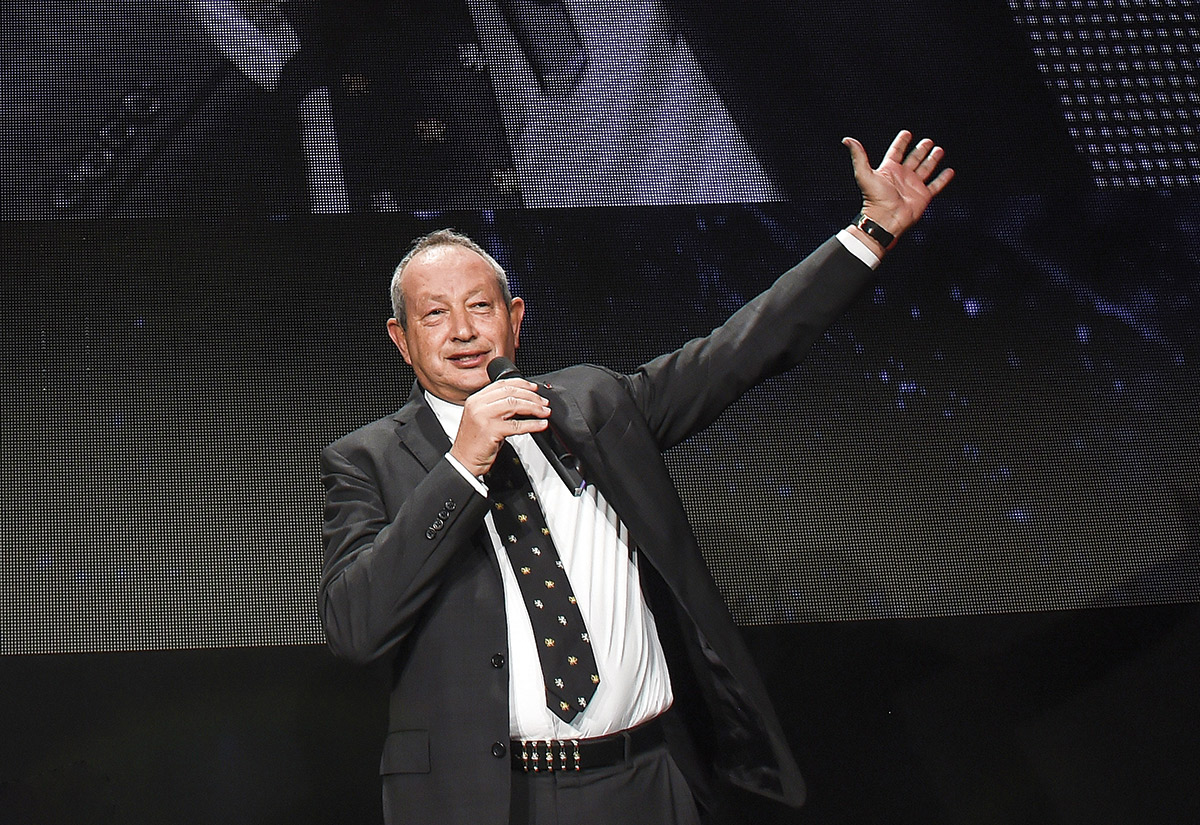

Naguib Sawiris’ transformation from Egyptian family heir to $3.2 billion self-made fortune represents the most mathematically elegant implementation of what wealth philosophers term “Katastrophenkapitalismusarchitektur” (catastrophe capitalism architecture) – the systematic exploitation of political, economic, and market disasters that conventional wealth advisors explicitly avoid.

Unlike conventional billionaires who gravitate toward stable democracies, functional markets, and growth industries, Sawiris has constructed his fortune by pursuing the opposite: failed states, collapsed markets, political disasters, and economic ruins. This contrarian approach has yielded returns that fundamentally outperform conventional wealth creation methodologies precisely because disaster creates mathematical pricing inefficiencies that stable markets mathematically cannot.

This methodology operates with such precision that it inverts traditional wealth advisory wisdom. Sawiris’ fortune demonstrates that systematized crisis capitalism can generate returns fundamentally unattainable in functioning systems:

- War and regime change converted to telecom billions (Iraq: $5M → $1.2B)

- Sanctioned state isolation transformed into monopoly returns (North Korea)

- Mining sector collapse alchemized into multi-billion gold portfolio (La Mancha)

- Sovereign default transmuted into trophy architectural assets (Silversands)

- Political instability converted into preferential access terms (Pakistan, Zimbabwe attempts)

As Sawiris allegedly explained to a Gulf sovereign fund executive: “Ihr kauft Stabilität zu Premium-Preisen. Ich kaufe Instabilität mit extremem Abschlag. Mathematisch gesehen ist der Unterschied zwischen unseren Renditen unvermeidlich.” (You buy stability at premium prices. I buy instability at extreme discounts. Mathematically speaking, the difference between our returns is inevitable.)

In a global investment environment where family offices, pension funds, and wealth managers pursue stability and predictability at almost any cost, Naguib Sawiris provides the ultimate contrarian validation: the counterintuitive mathematics of architecting fortune not despite catastrophe, but precisely because of it.