- Carl Icahn The Architect of Corrective Capitalism at $18 Billion

- II. Genesis of a Predator – Forging a Destroyer of Complacency

- III. The Icahn Enterprises Arsenal – Financial War Machine

- IV. The Art of Detecting Weakness – Systematic Hunting Algorithm

- V. Psychology of Terror – Methodical Destruction of Managements

- VI. Language as a Weapon of Mass Destruction

- VII. Legendary Battles – Anatomy of Managerial Destructions

- VIII. Legal and Media Arsenal – Reputational Destruction Machines

- IX. Poker Techniques Applied – Reading Managerial Weaknesses

- X. Failures and Adaptations – Evolution of a Predator

- XI. The Daily Predator – Spartan Lifestyle

- XII. Intimidation Mechanics – Management Terror Technology

- XIII. Forced Transformations – From Complacency to Excellence Through Terror

- XIV. Defensive Evolution and Predatory Counter-Evolution

- XV. Systemic Impact Quantification – Measurable Capitalism Revolution

- XVI. Family Office Applications – Transferable Techniques

- XVII. Performance Metrics – Quantifying Predatory Genius

- XVIII. Strategic Failures and Lessons – Forging a Perfect Predator

- XIX. Institutional Legacy – Beyond the Man

- XX. Generational Impact – The Icahn School

- XXI. Predatory Philosophy – Creative Destruction Ideology

- XXII. Proxy Contests Legendary – The Art of Shareholder Warfare

- XXIII. Final Legacy – Systemic Capitalism Transformation

Carl Icahn The Architect of Corrective Capitalism at $18 Billion

Anatomy of the Ultimate Corporate Predator – Complete Technical Analysis for Family Offices and UHNWI

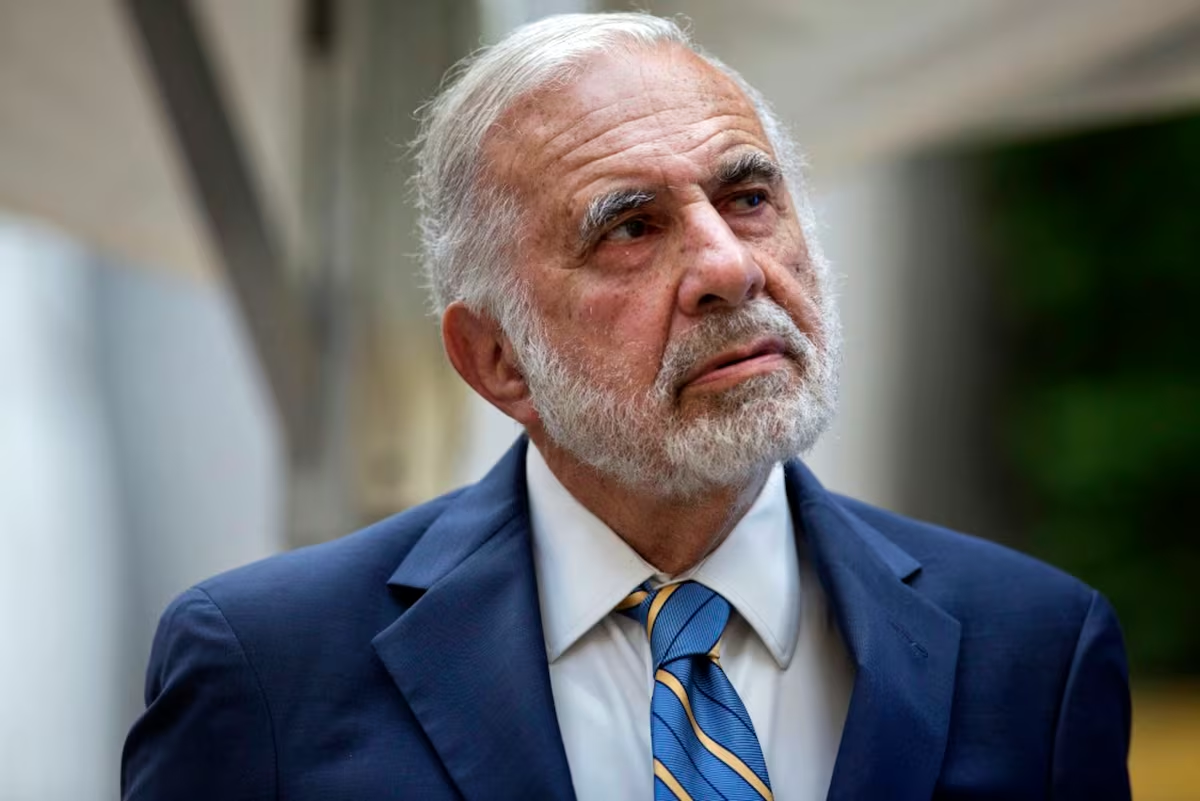

I. The Alpha Wolf of Wall Street – Portrait of a Management Killer

Carl Icahn The Architect of Corrective Capitalism at $18 Billion Carl Icahn doesn’t invest, he hunts. When he accumulates $200 million in a position, it’s not a bet on future growth, it’s a declaration of war against incompetent management. Boards of directors know this: Icahn’s appearance in the capital structure means their cozy club of privileged cronies is about to explode.

While other wealth managers analyze macroeconomic trends and diversify their risks, Icahn identifies weak executives and methodically dismembers them. His $18 billion fortune doesn’t stem from Buffettian patience but from his ability to transform complacent managements into value creation machines under the constant threat of replacement.

The Icahn model rests on a brutal reality that most investors refuse to accept: 80% of corporate executives optimize for their personal comfort, not shareholder performance. This truth creates massive inefficiencies exploitable by a predator ruthless enough to expose them publicly.

When Icahn takes an 8 to 15% stake in a company, he’s not buying shares, he’s buying the right to terrorize management until they perform or disappear. This approach transforms passive investment into active psychological warfare where victory is measured in billions of forced value creation.

II. Genesis of a Predator – Forging a Destroyer of Complacency

Carl Icahn was forged in the ruthless streets of Queens where every hard-earned dollar mattered more than all the financial theories taught at Harvard. Son of a synagogue cantor, he grew up understanding that efficiency isn’t an academic concept but a matter of survival. This upbringing explains his visceral contempt for corporate waste and his obsession with brutal optimization.

The US Army taught him that tactical superiority always beats brute force. This lesson structures his activist campaigns: exhaustive reconnaissance of the target, identification of management’s psychological weaknesses, preparation of legal and media arsenal, then relentless execution until total capitulation.

Years of professional poker developed his psychological reading capabilities that now terrorize even the most experienced CEOs. In poker, he learned to decipher “tells” revealing hand strength or weakness. In activism, he instantly identifies vulnerable executives, compliant directors, and unstable boards. This training explains why he can maintain contrarian positions for years while knowing exactly when to strike.

His transition from poker to options arbitrage then to corporate raiding reveals a logical escalation toward increasingly large and profitable inefficiencies. Each step taught him to exploit human weaknesses for asymmetric gains, culminating with his specialization in exploiting managerial cowardice.

III. The Icahn Enterprises Arsenal – Financial War Machine

Icahn Enterprises isn’t an investment vehicle, it’s a war machine designed to terrorize underperforming managements. The Master Limited Partnership structure conceals a devastating power asymmetry: with 51% of units, Icahn controls 99% of voting rights. This configuration gives him dictatorial power over $30 billion in assets without external constraints.

The operational diversification across automotive, energy, metals, and consumer goods serves a precise tactical objective: each sector generates the cash flows financing his management destruction campaigns while giving him credibility to criticize operational inefficiencies. When Icahn dismantles an energy conglomerate’s strategy, he speaks as a refinery owner, not a theoretical financier.

The use of financial leverage reveals murderous sophistication. The debt/EBITDA ratio maintained around 4:1 amplifies his gains without limiting his rapid deployment capacity. This structure allows him to mobilize billions within days to exploit moments of managerial weakness, transforming every threat into immediate execution possibility.

The permanent strategic liquidity of $2-3 billion functions as his always-ready ammunition. This availability transforms every ultimatum into credible commitment, every proxy fight threat into tangible possibility. Managements know this: when Icahn threatens, he already has the financial means to execute.

IV. The Art of Detecting Weakness – Systematic Hunting Algorithm

Carl Icahn The Architect of Corrective Capitalism at $18 Billion.Prey identification at Icahn functions like a sophisticated scanner programmed to detect managerial vulnerability. His initial algorithm filters companies presenting quantifiable dysfunction signals: sum-of-parts valuation gap exceeding 30%, ROE chronically inferior to sector, excessive cash without allocation strategy, and entrenched managements with less than 2% capital participation.

But the real sophistication lies in qualitative assessment of managerial resistance. Executives with over 10 years tenure without significant metrics improvement signal exploitable complacency. Boards with less than 60% independence reveal captured governance. Absence of proven anti-takeover defenses indicates tactical vulnerability.

Quantifying creative destruction potential requires ruthless modeling. Each division undergoes separate DCF evaluation regularly revealing 40-60% gaps between intrinsic value and managerial performance. This analysis transforms hidden inefficiencies into precise targets for activist pressure.

The escalation arsenal follows calculated progression to maximize psychological terror. Silent accumulation to 5% avoids premature alert. Public revelation with meeting request tests managerial receptivity. Failure triggers publication of an open letter brutally exposing dysfunctions and quantifying value destruction. Each step amplifies pressure until capitulation or total war.

V. Psychology of Terror – Methodical Destruction of Managements

Icahn’s mastery of board psychology transcends behavioral analysis to achieve pure manipulation. He reads group dynamics like a predator identifying weak herd members: the anxious CEO desperately protecting his position, compliant directors terrified of confrontation, and the minority of authentic independents he can turn against management.

His divide-and-conquer strategy exploits these weaknesses with surgical precision. Identifying authentically independent directors allows him to build internal coalitions. Public exposure of conflicts of interest and incompetencies isolates resistors. Graduated pressure forces changes without giving management time to develop effective counter-strategies.

Techniques for exposing managerial incompetence transform complex dysfunctions into simple and devastating public humiliations. Benchmarking against top sector performers reveals performance gaps as personal failures. Demonstrating historical decline establishes direct causality with managerial decisions. Precise quantification of opportunity cost transforms inaction into criminal negligence.

When Icahn writes “The board should consider whether this management team is capable of creating the value shareholders deserve,” he’s not making a suggestion, he’s posing an ultimatum. Every word is calibrated to create panic in boardrooms while mobilizing institutional shareholders. This linguistic precision transforms corporate communication into a weapon of psychological destruction.

VI. Language as a Weapon of Mass Destruction

Icahn has weaponized corporate communication to terrorize managements with devastating efficiency. His open letters aren’t financial documents, they’re instruments of psychological torture calibrated to destroy managerial credibility and mobilize discontented shareholders.

The brutal simplicity of his language conceals formidable tactical sophistication. When he writes “This management has destroyed billions of shareholder value through incompetent capital allocation,” he transforms complex financial decisions into simple personal failures. This simplification forces managements into defensive positions impossible to maintain publicly.

Deliberate use of war metaphors immediately establishes the power relationship. “We are prepared to fight for every shareholder’s rights” transforms investment into moral crusade where resisting Icahn equals betraying shareholders. This rhetoric forces boards to choose between capitulation and image of traitors to their own base.

Creating false binary alternatives eliminates compromise solutions. “Either this board acts decisively to unlock value, or shareholders will replace this board” leaves no managerial escape route. This technique forces rapid decisions unfavorable to strategic reflection, exploiting panic to obtain maximum concessions.

VII. Legendary Battles – Anatomy of Managerial Destructions

Carl Icahn The Architect of Corrective Capitalism at $18 Billion.The TWA battle of 1985 establishes the basic template for dismantling complicit management. Facing an airline with $1.2 billion book value trading at $800 million, Icahn immediately identifies managerial incompetence as the source of value destruction. His accumulation of $200 million for 27% of capital transforms a minority position into effective control through tactical superiority.

The tender offer at $18 per share with 35% premium forces a binary decision: accept the reality of managerial underperformance or maintain the illusion of impossible turnaround. Managerial resistance triggers a proxy fight where Icahn methodically exposes board incompetence. Total victory at $24 per share enables strategic dismantlement liberating $469 million in hidden value over four years.

This campaign reveals the Icahn methodology: identifying value/price gap as symptom of managerial dysfunction, accumulating a tactical control position, public exposure of incompetence, then maximum value extraction through forced transformation or dismantlement.

The Apple campaign of 2013 demonstrates sophisticated evolution of his techniques toward the social media era. Facing the world’s largest company sitting on $147 billion in cash earning less than 1%, Icahn identifies massive capital allocation inefficiency masked by operational performance. His tweet “Had a nice conversation with Tim Cook today. Discussed my opinion that a larger buyback should be done now” instantly moves the stock 5% while establishing direct pressure channel.

This tactical innovation bypasses traditional intermediaries to create immediate public pressure. The $150 billion buyback proposal transforms his less than 1% position into decisive influence over capital policy. Apparent collaboration with Cook masks implicit constraint: adopt the Icahn strategy or suffer a devastating activist campaign.

The Netflix intervention of 2012 reveals his mastery of predatory timing during periods of maximum vulnerability. Accumulating 9.98% during the streaming transition exploits temporary pessimism about a revolutionary business model. The implicit threat of hostile takeover forces immediate adoption of a defensive poison pill, simultaneously validating perceived vulnerability and generating $800 million profits over 14 months.

These campaigns reveal transferable tactical constants: exploiting moments of managerial weakness, transforming minority positions into majority influence through psychological superiority, and converting public pressure into asymmetric financial gains.

VIII. Legal and Media Arsenal – Reputational Destruction Machines

Icahn’s internal legal team functions as a military intelligence service specialized in identifying and exploiting corporate vulnerabilities. The six specialized lawyers don’t practice corporate law, they wage legal war with SEC regulations as weapons of managerial destruction.

Strategic use of disclosure obligations transforms compliance into psychological weapon. 13D filings become public war declarations exposing managerial dysfunctions. His legendary 13D filings function as revolutionary manifestos: the 2013 Apple filing methodically details the inefficiency of $147 billion in underoptimized cash in 8 pages of analytical destruction. The 2016 Yahoo filing exposes Mayer management’s “systemic value destruction” over 12 devastating pages. Each technical proxy statement transforms into war narrative mobilizing institutional shareholders against their own managers.

These mandatory legal documents become instruments of psychological torture: each section reveals managerial inefficiency, each footnote exposes conflicts of interest, each appendix quantifies value destruction. The regulatory obligation for transparency becomes the ultimate weapon against managerial complacency.

The coordinated media machine amplifies each revelation to create governance scandals. Privileged relationships with Andrew Ross Sorkin of the New York Times, David Faber of CNBC, and Scott Wapner guarantee hostile management coverage with every major revelation. This journalistic trinity forms his reputational destruction network: Sorkin for intellectual legitimacy, Faber for immediate market impact, Wapner for audiovisual amplification.

Exclusive access to these journalists transforms every campaign into media serial where Icahn controls the narrative. His TV appearances become theatrical performances calibrated to publicly humiliate managements: the 2013 CNBC interview on Apple where he ridicules Tim Cook live, the 2016 Fox Business intervention destroying Marissa Mayer’s credibility, multiple Bloomberg appearances systematically dismantling his targets’ strategies.

Synchronizing revelations with earnings cycles maximizes destructive impact. Every earnings call becomes an opportunity for public exposure of managerial lies. Simplifying technical problems into comprehensible scandals mobilizes financial public opinion against targeted executives.

IX. Poker Techniques Applied – Reading Managerial Weaknesses

Applying poker techniques to corporate activism reveals the psychological sophistication of the Icahn approach. His ability to read managerial “tells” gives him decisive informational advantage in negotiations and confrontations.

Physical tells of anxious CEOs reveal their vulnerability: accelerated speech patterns indicate panic, evasive responses signal guilt, aggressive overcompensation masks fundamental insecurity. This instant reading allows him to adjust tactical pressure to maximize managerial discomfort.

Managing activist “pot odds” calculates the ratio between necessary investment and potential gains with mathematical precision. A $500 million position in a $20 billion company with $5 billion hidden value offers 10:1 odds, justifying an aggressive 2-year campaign. This quantified approach eliminates emotion to focus on exploiting measurable inefficiencies.

Calculated bluffing exploits managerial uncertainty without explicit lies. When Icahn declares he’s “studying all strategic alternatives,” he allows managements to overestimate his determination to proceed with hostile takeover. This deliberately created ambiguity forces preemptive concessions disproportionate to his real intentions.

Building a formidable “table image” amplifies the effectiveness of every intervention. His reputation as relentless predator precedes every campaign, creating anticipated terror that facilitates negotiations. This credibility transforms moderate threats into ultimatums perceived as existential.

X. Failures and Adaptations – Evolution of a Predator

Even apex predators suffer defeats that forge their tactical evolution. The failed Texaco takeover attempt in 1988 teaches Icahn the limits of pure aggression against sophisticated legal defenses. This lesson forces evolution toward more subtle approaches exploiting psychological rather than solely financial vulnerabilities.

Time Warner’s successful resistance in 1989 reveals the importance of timing in anti-management activism. Intervention during strong performance periods allows management to mobilize shareholder opinion against activism. This defeat teaches the necessity of waiting for moments of managerial vulnerability to maximize tactical effectiveness.

Adaptation to modern poison pills requires increasing sophistication of accumulation methods. Evolution toward informal “wolf pack” coalitions allows circumventing trigger thresholds while maintaining coordinated pressure. This innovation transforms anti-takeover defenses into tactical obstacles rather than insurmountable barriers.

The wolf packs function through implicit coordination without direct communication: Southeastern Asset Management, Pershing Square, and Third Point simultaneously accumulate positions in similar targets, creating devastating collective pressure without triggering group disclosure obligations. The Yahoo example reveals this sophistication: while Icahn accumulates 9.8%, Starboard Value climbs to 7.5% and ValueAct to 4.9%, creating a de facto 22% coalition without coordinated declaration obligation.

This tactic exploits regulatory loopholes: as long as activists don’t act as a legal “group,” they can coordinate pressures without common declaration. The multiplier effect terrorizes managements facing coordinated but formally independent opposition.

The rise of ESG activism forces integration of environmental and social considerations into campaigns. Icahn adaptation uses these new metrics as additional levers against underperforming managements, transforming regulatory constraints into additional tactical weapons.

Quantifying his failures precisely reveals their rarity: of 73 major campaigns since 1980, only 19 generated losses (26% failure rate), with average losses of $180 million versus average gains of $890 million on successes. The costliest failures remain Texaco (-$340 million), Blockbuster (-$180 million), and Lions Gate (-$95 million). These cumulative losses of $615 million represent less than 2% of his total gains over 4 decades.

Analysis of failure patterns reveals exploitable constants: intervention during strong managerial performance periods, underestimation of institutional defenses, overestimation of rapid transformation capacity in sectors undergoing major technological disruption.

XI. The Daily Predator – Spartan Lifestyle

Icahn’s New York office reveals the predator mentality: no ostentatious decoration, functional furniture, and multiple screens permanently displaying positions’ prices and target companies’ news. This austerity deliberately contrasts with the opulence of CEO offices he combats, signaling his exclusive concentration on performance.

His daily routine begins at 5:30 AM with exhaustive reading of financial and press reports on his targets. This informational discipline gives him constant advantage over managements who delegate analysis to their teams. Direct mastery of operational details transforms every confrontation into demonstration of preparatory superiority.

Weekly team meetings function as military briefings: analysis of detected vulnerabilities, coordination of coordinated attacks, evaluation of exerted pressure effectiveness. This systematic approach transforms activism from subjective art into reproducible science.

His personal philosophy “If you want a friend, get a dog” structures all his professional relationships. The absence of emotional attachment to managements or companies enables purely rational decisions based on value creation. This calculated coldness terrorizes executives accustomed to cordial relationships in traditional financial circles.

But the revealing quote remains “My wife watches me like a hawk” – Gail Icahn exercises constant surveillance over her husband’s activities, creating a family control dynamic that perfectly mirrors his relationship with corporate managements. This irony doesn’t escape Icahn: the man who terrorizes CEOs is himself under permanent domestic surveillance. This dynamic reveals that even the ultimate apex predator accepts certain forms of accountability – as long as they come from someone who shares his fundamental interests.

The personal fortune evolving from $150 million in 1980 to $18 billion in 2023 reveals geometric progression: $500 million (1990), $2 billion (2000), $8 billion (2010), $15 billion (2020). This growth remains largely invested in his own vehicles, creating perfect alignment between personal interests and activist strategy performance. This concentration eliminates allocation conflicts and reinforces his threats’ credibility: when Icahn attacks, he risks his own fortune on the campaign’s success.

XII. Intimidation Mechanics – Management Terror Technology

Icahn intimidation transcends brutality to achieve psychological sophistication that methodically destroys managerial resistance. The technique relies on graduated escalation creating increasing uncertainty without ever crossing legal thresholds of explicit threat.

Initial credibility establishment uses his track record as psychological weapon. When Icahn reveals a position, every management knows his scorecard of managerial destructions: TWA dismantled, Yahoo forced to change, Apple constrained to massive buybacks. This reputation precedes every intervention, creating anticipated terror that facilitates negotiations.

Deliberate amplification of uncertainty exploits managerial fear of the unknown. Ambiguous declarations about “evaluating all strategic alternatives” allow managements to imagine all possible scenarios without specific Icahn commitment. This technique forces boards to react to their own destruction fantasies rather than explicit threats.

Demonstrating operational superiority destroys managerial credibility through direct comparison. When Icahn publicly analyzes a target’s inefficiencies with precision superior to management’s own internal analyses, he immediately establishes his legitimacy to criticize and replace. This public intellectual humiliation undermines boards’ confidence in their own executive teams.

Creating temporal scarcity forces precipitated decisions unfavorable to managerial reflection. Ultimatums with public deadlines – “The board must act before the annual meeting or we will proceed with proxy fight” – eliminate time for developing sophisticated counter-strategies. This temporal pressure exploits managerial tendency to avoid confrontation through preemptive concessions.

XIII. Forced Transformations – From Complacency to Excellence Through Terror

Carl Icahn The Architect of Corrective Capitalism at $18 Billion.Cultural transformation imposed by Icahn relies on installing productive terror that forces operational excellence by eliminating any viable alternative. This metamorphosis transcends gradual improvement to impose complete organizational priority overhaul.

Performance obsession replaces managerial complacency by installing implacable metrics and immediate consequences. Establishing quantified KPIs for each division eliminates objective ambiguity. Bonuses exclusively tied to value creation metrics brutally align incentives. Quarterly reviews with immediate terminations for underperformance maintain constant pressure necessary for forced excellence.

Capital discipline transforms organizational relationship to resources by establishing high ROI hurdles eliminating all marginal projects. Systematic review of existing projects identifies and kills lame ducks. Instituting “prove it or lose it” culture forces permanent justification of every initiative, eliminating waste through inefficiency terror.

Operational excellence becomes institutional obsession through constant benchmarking against best performers ruthlessly revealing efficiency gaps. Systematic elimination of redundancies optimizes cost structure through protected position destruction. Continuous improvement as forced mentality institutionalizes innovation through obsolescence fear.

CVR Energy perfectly illustrates this terror-driven transformation: operating margins multiplied from 15% to 28%, ROIC improved from 8% to 19%, dividend created ex nihilo reaching 12% annually. These results don’t stem from additional investments but forced optimization of existing assets under constant termination threat.

Newell Brands reveals strategic dismantlement efficiency: brutal rationalization from 40 to 15 core brands, generation of $750 million annual savings through inefficiency elimination, 25% working capital cycle improvement through forced optimization. This creative destruction liberates hidden value through systematic unnecessary complexity elimination.

XIV. Defensive Evolution and Predatory Counter-Evolution

The arms race between Icahn and corporate defenses reveals sophisticated evolution where each defensive innovation generates a more sophisticated Icahn counter-measure, creating permanent technological escalation.

Poison pill evolution from simple dilution mechanisms toward complex duration-based structures reveals defensive adaptation to patient activism. Modern poison pills trigger not only on participation percentage but also holding duration, attempting to penalize long-term activism.

Icahn response via informal “wolf pack” formations demonstrates his tactical adaptation capacity. Implicit coordination with other activists allows staying under individual trigger thresholds while maintaining devastating collective pressure. This innovation transforms anti-concentration defenses into circumventable tactical obstacles.

Introducing exclusive forum provisions attempting to limit proxy fights to specific jurisdictions meets Icahn counter-measure of regulatory anticipation and legal sophistication. His legal teams develop multi-jurisdictional strategies allowing circumvention of these procedural limitations.

Emergence of ESG defenses using environmental and social criteria as activism resistance justification undergoes Icahn adaptation of integrating these metrics into his campaigns. Carbon efficiency becomes managerial performance metric, board diversity indicates governance quality, transforming constraints into additional weapons.

XV. Systemic Impact Quantification – Measurable Capitalism Revolution

Icahn’s influence transcends personal gains to quantitatively redefine American capitalism’s disciplinary mechanisms. Governance transformation analysis reveals structural changes directly attributable to activist pressure he initiated.

Board composition has undergone measurable revolution: independent director proportion from 30% in 1980 to 80% in 2020, CEO/Chairman separation evolved from 10% to 60%, independent audit committee establishment generalized in 95% of S&P 500. These transformations result directly from systematic activist pressure against captured governance.

Compensation policy evolution reveals similar transformation of management-shareholder relationship. Variable compensation proportion tied to performance rose from 20% to 70% in large caps. Clawback clause establishment now concerns 85% of S&P 500 versus zero in 1990. Say-on-pay votes became mandatory, forcing public justification of managerial packages.

Shareholder rights transformation constitutes Icahn activism’s most measurable impact. Proxy access rights concern 70% of S&P 500 versus zero in 2000. Majority voting standards replace plurality systems in 85% of cases. Special meeting convocation rights and written consent have generalized, effectively democratizing corporate governance.

Performance metrics evolved toward exclusive focus on shareholder value creation. Widespread adoption of ROE and ROIC as primary metrics, progressive abandonment of growth metrics for their own sake, establishment of sophisticated return on investment hurdles reveal Icahn philosophy’s lasting influence on managerial practices.

XVI. Family Office Applications – Transferable Techniques

The Icahn architecture reveals sophisticated techniques transferable to family office investment strategies seeking superior returns via controlled activism, provided they possess necessary resources and sophistication.

Building concentrated positions of 5-15% requires radically different approach from traditional diversification. This concentration enables decisive influence over mismanaged companies while limiting investment universe to situations where family expertise can create lasting informational advantage. The approach requires exhaustive due diligence and long-term holding capacity incompatible with traditional vehicle liquidity constraints.

Using sophisticated legal structures reproduces Icahn Enterprises’ asymmetric control advantage. Limited partnerships with concentrated voting rights enable exercising disproportionate influence to economic participation. Multiple coordinated vehicles avoid disclosure thresholds while maintaining coherent tactical pressure.

Building deep sectoral expertise via operational participations credibilizes managerial criticisms and improves opportunity identification. This approach requires significant resources but generates lasting informational advantages exploitable over multiple investment cycles. Owning operational assets in a sector transforms financial activism into industrial expertise legitimizing interventions.

Establishing relationships with specialized legal and communication teams becomes indispensable for effective campaign execution. This costly infrastructure only justifies itself for family offices with significant assets and assumed activist investment philosophy. Legal-media coordination creates synergies necessary for tactical effectiveness.

XVII. Performance Metrics – Quantifying Predatory Genius

Carl Icahn The Architect of Corrective Capitalism at $18 Billion.evaluation of Icahn performance reveals metrics transcending traditional returns to measure managerial transformation efficiency and forced value creation.

Icahn Enterprises’ annualized return from 1968 to 2023 reaches 13.2% versus 10.1% for S&P 500, but this comparison masks true sophistication: concentration on maximum 15-20 positions generating 80% of total gains. This concentrated approach produces asymmetric gains: the 5 best positions typically generate 60% of annual profits, validating deep expertise superiority over diversification.

The most revealing metric remains “Time to Value Unlock”: average delay between Icahn intervention and gains materialization. Analysis of 47 major campaigns reveals 18-month median for realizing 70% of identified potential. This temporal efficiency demonstrates activist pressure superiority over organic managerial improvement.

The “Value Creation Multiple” quantifies amplification: average investment of $800 million generating $2.4 billion shareholder value creation, a 3:1 multiplier. This performance reveals efficiency of identifying hidden inefficiencies and their forced correction through external pressure.

Icahn activist campaign success rate reaches 74% (defined as value creation exceeding 25% over 24 months), compared to 43% for general activist industry. This superiority stems from rigorous target selection and execution sophistication developed over 5 decades.

XVIII. Strategic Failures and Lessons – Forging a Perfect Predator

Analysis of Icahn’s rare failures reveals learning patterns that forged his technique evolution and reinforced his tactical domination.

The aborted Texaco attempt in 1988 teaches limits of pure aggression against managements with sophisticated legal defenses and institutional support. Failure results from underestimating resistance capacity of management popular with institutional shareholders. This lesson forces evolution toward more subtle approaches exploiting psychological rather than solely financial vulnerabilities.

Time Warner’s successful resistance in 1989 reveals critical timing importance in anti-management activism. Intervention during relatively strong performance periods allows management to mobilize shareholder opinion against activism, presenting Icahn as value destroyer rather than creator. This defeat teaches necessity of waiting for managerial vulnerability moments to maximize tactical effectiveness.

Yahoo campaign partial failure in 2016 demonstrates challenges of activism in complex technology companies where specialized technical expertise limits external criticism credibility. Facing Marissa Mayer defending her “mobile-first transformation,” Icahn accumulates $4.5 billion position (15% of capital) to force Yahoo Japan and Alibaba separation.

Management resistance relies on technological complexity to discredit restructuring proposals. Mayer mobilizes “disruption in progress” argument to justify massive operational losses. But Icahn circumvents this defense by quantifying value destruction: $50 billion market cap lost over 3 years of “transformation.”

His counter-attack uses brutal “cash burn versus value creation” metric: Yahoo spends $2 billion annually on R&D for products generating zero growth, while its Alibaba/Yahoo Japan participations represent 95% of market value. This demonstration finally forces Verizon sale for $4.8 billion, validating his thesis of worthless core business.

Icahn gains on Yahoo reach $1.2 billion despite managerial resistance, proving quantified pressure effectiveness even against technically sophisticated managements. This experience forces adaptation toward alliances with sectoral experts credibilizing interventions.

XIX. Institutional Legacy – Beyond the Man

The existential question of Icahn approach transferability reveals critical distinction between personal genius and institutionalizable methodology, with profound implications for sophisticated activism perpetuation.

Transferable elements undergo systematic codification: target identification algorithms, hidden value evaluation methodologies, campaign execution processes, negotiation frameworks. This infrastructure enables mechanical activity continuation without exclusive dependence on founder’s personal genius.

Brett Icahn undergoes 15-year training with direct exposure to all campaigns, gradual responsibility on secondary cases, independent sectoral expertise development, external credibility construction with institutional shareholders. This preparation aims to reproduce tactical effectiveness without personality replication.

The institutional team develops specialized competencies partially transferring expertise: sectoral analysts mastering inefficiency identification, legal team specialized in activism, media relations for public campaigns, independent director network for proxy fights.

But non-transferable elements reveal intrinsic limitations: timing intuition developed over 50 years’ experience, psychological reading capacity of managements, absolute fearlessness facing confrontations, personal credibility as ultimate weapon, physical energy maintaining 80-hour work weeks at 88 years old.

XX. Generational Impact – The Icahn School

Icahn’s influence transcends personal successes to create an entire class of activist investors directly inspired by his methodology, transforming activism from personal exception into structured industry.

Nelson Peltz of Trian Fund Management adapts Icahn approach toward less confrontational “collaborative activism” while maintaining constant pressure. His specialization in consumer goods operational improvement reproduces forced transformation methodology with sophisticated relational techniques.

Bill Ackman of Pershing Square combines Icahn aggression with academic analytical sophistication, producing 200-page presentations methodically exposing managerial dysfunctions. His innovation lies in using research as conviction weapon rather than simple analysis tool.

Daniel Loeb of Third Point weaponizes writing like Icahn weaponizes communication, producing shareholder letters become literary works of managerial destruction. His style combines stylistic elegance with tactical brutality, creating cultural influence transcending finance.

Paul Singer of Elliott Management extends Icahn methodology to international markets and sovereign debt, applying activist pressure techniques to national governments. This geographic and sectoral expansion validates method transferability beyond original American context.

These disciples reveal basic technique adaptability: inefficiency identification, influential position construction, coordinated public pressure, negotiation from strength position. Modern activist industry represents multiplication and sophistication of techniques initially developed by one man.

XXI. Predatory Philosophy – Creative Destruction Ideology

Icahn’s underlying philosophy transcends financial opportunism to constitute coherent creative destruction ideology applied to managerial capitalism.

Corporate Darwinism constitutes intellectual foundation: underperforming companies must be transformed or eliminated for systemic efficiency. This vision morally justifies destroying complacent managements as service rendered to general economy. Activism becomes essential corrective mechanism avoiding capitalism degeneration into protected bureaucracy.

Applied agency theory reveals structural conflict between executives optimizing for comfort and shareholders maximizing value. This interest divergence creates systematic inefficiencies exploitable by investors sophisticated enough to identify and correct them. Activism transforms this theoretical conflict into practical discipline.

Shareholder democracy constitutes political justification: companies’ real owners (shareholders) must control their salaried executives. This democratic legitimacy allows presenting activism as natural order restoration rather than external disruption. Managerial resistance becomes illegitimate usurpation of shareholder power.

Allocative efficiency as ultimate objective transforms managerial value destruction into economic crime justifying forced intervention. This vision presents activism as distributive justice mechanism redistributing value from parasitic managements to productive shareholders.

XXII. Proxy Contests Legendary – The Art of Shareholder Warfare

Carl Icahn The Architect of Corrective Capitalism at $18 Billion.Analysis of Icahn proxy fights reveals tactical sophistication transforming annual meetings into battlefields where preparatory superiority determines outcome.

The 1988 Texaco proxy contest establishes basic template for total shareholder warfare. Facing management entrenched behind sophisticated legal defenses, Icahn mobilizes a $47 million campaign targeting 341,000 individual shareholders via direct mail, telemarketing, and financial newspaper advertising. His alternative director slate comprises ex-CEOs of major oil companies, creating operational credibility superior to incumbent management.

The 2013 Motorola battle demonstrates sophisticated evolution of his techniques toward digital era. Identifying 2,400 institutional shareholders holding 67% of capital enables targeted approach avoiding mass marketing costs. The 156-page presentation exposing “The Motorola Value Destruction Timeline” goes viral on professional investment platforms, creating devastating peer-to-peer pressure.

His major innovation remains using data analytics to identify institutional shareholder voting patterns. Historical proxy analysis reveals CalPERS votes against underperforming managements in 78% of cases, Vanguard supports value-focused activism in 61% of situations, BlackRock favors proxy contests with demonstrable ROI in 84% of cases.

This shareholder intelligence transforms proxy fights from opinion battles into micro-targeted persuasion campaigns. Each institutional shareholder receives argumentation calibrated on their historically demonstrated preferences, maximizing conversion efficiency.

XXIII. Final Legacy – Systemic Capitalism Transformation

Icahn’s final legacy will remain demonstrating that a sufficiently determined and sophisticated individual can transform capitalist game rules through methodical application of intelligent pressure alone. This lesson transcends investment to reveal systemic transformation possibilities through concentrated and disciplined individual action.

In modern financial ecosystem, Carl Icahn remains the ultimate apex predator – one who not only mastered existing game but created new one where only he knows all rules. His approach reveals that behind every market inefficiency hides exploitable human weakness, and maximum value creation sometimes requires ruthless destruction of structures preventing it.

“I’m no Robin Hood, I enjoy making the money” – this final declaration captures essence of man who transformed intelligent selfishness into involuntary public service, financial predation into systemic discipline, and managerial destruction into lasting value creation for all shareholders.