- The 30 Family Businesses of the Middle East : Strategic Concentration, Financial Governance Excellence, and the Emergence of a New Global Economic Epicenter

- I. A Strategy of Concentration for Total Control Over the Value Chain

The 30 Family Businesses of the Middle East : Strategic Concentration, Financial Governance Excellence, and the Emergence of a New Global Economic Epicenter

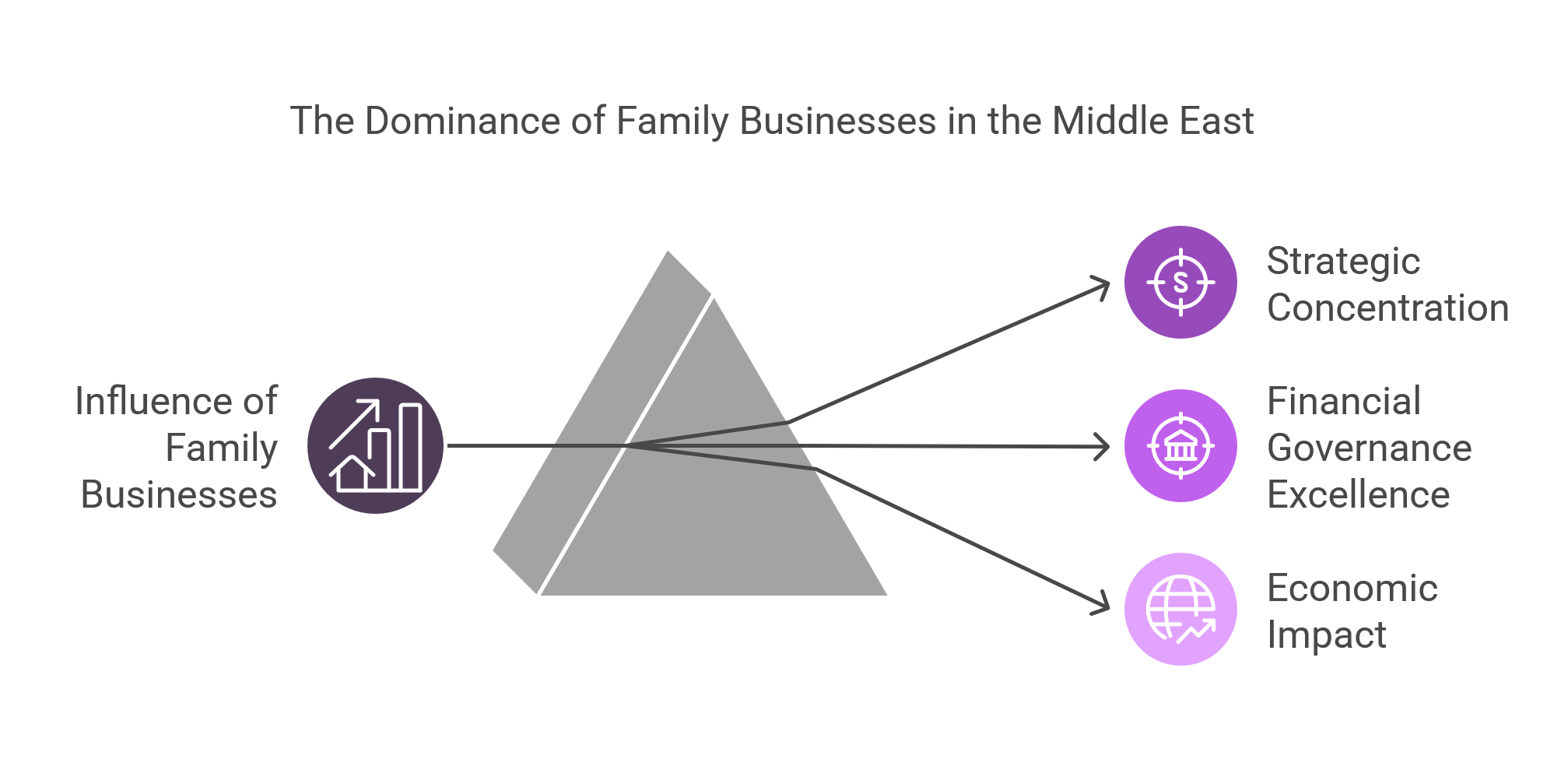

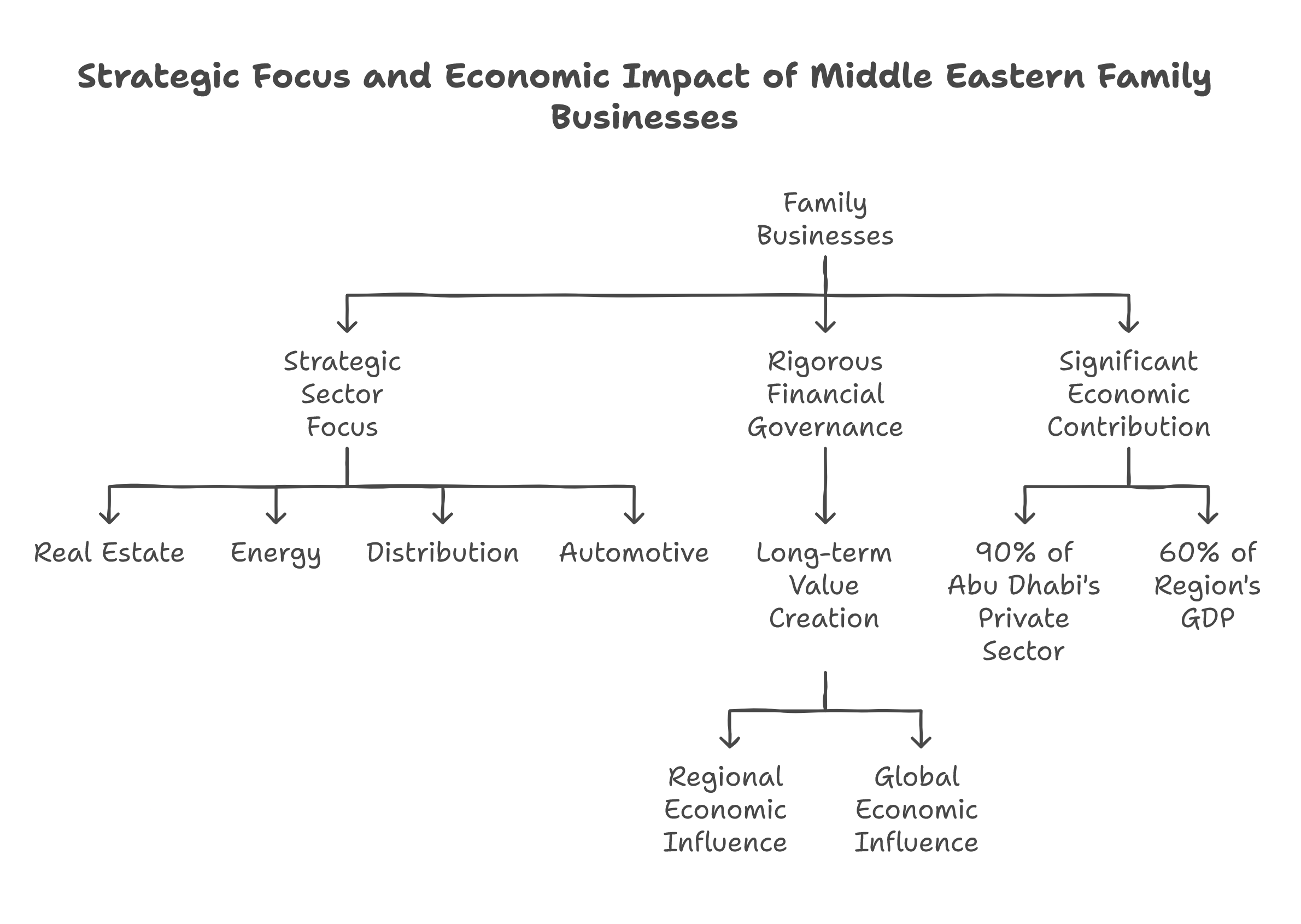

The 30 Family Businesses of the Middle East .The Middle East today is distinguished by the predominant influence of its family businesses, which serve as true bastions of resilience and financial innovation. Rather than dispersing their investments in superficial diversification, these conglomerates concentrate on strategic sectors such as real estate, energy, distribution, and automotive. This focused approach, combined with rigorous financial governance, enables them to generate long-term value and exert considerable influence over both regional and global economies.

According to a KPMG study, 90% of Abu Dhabi’s private sector is owned by family businesses, which account for nearly 60% of the region’s GDP. With a combined capitalization exceeding USD 1 trillion and assets concentrated in high-value segments, these family businesses exemplify a resilient economic model, capable of successfully navigating a perpetually shifting global landscape.

I. A Strategy of Concentration for Total Control Over the Value Chain

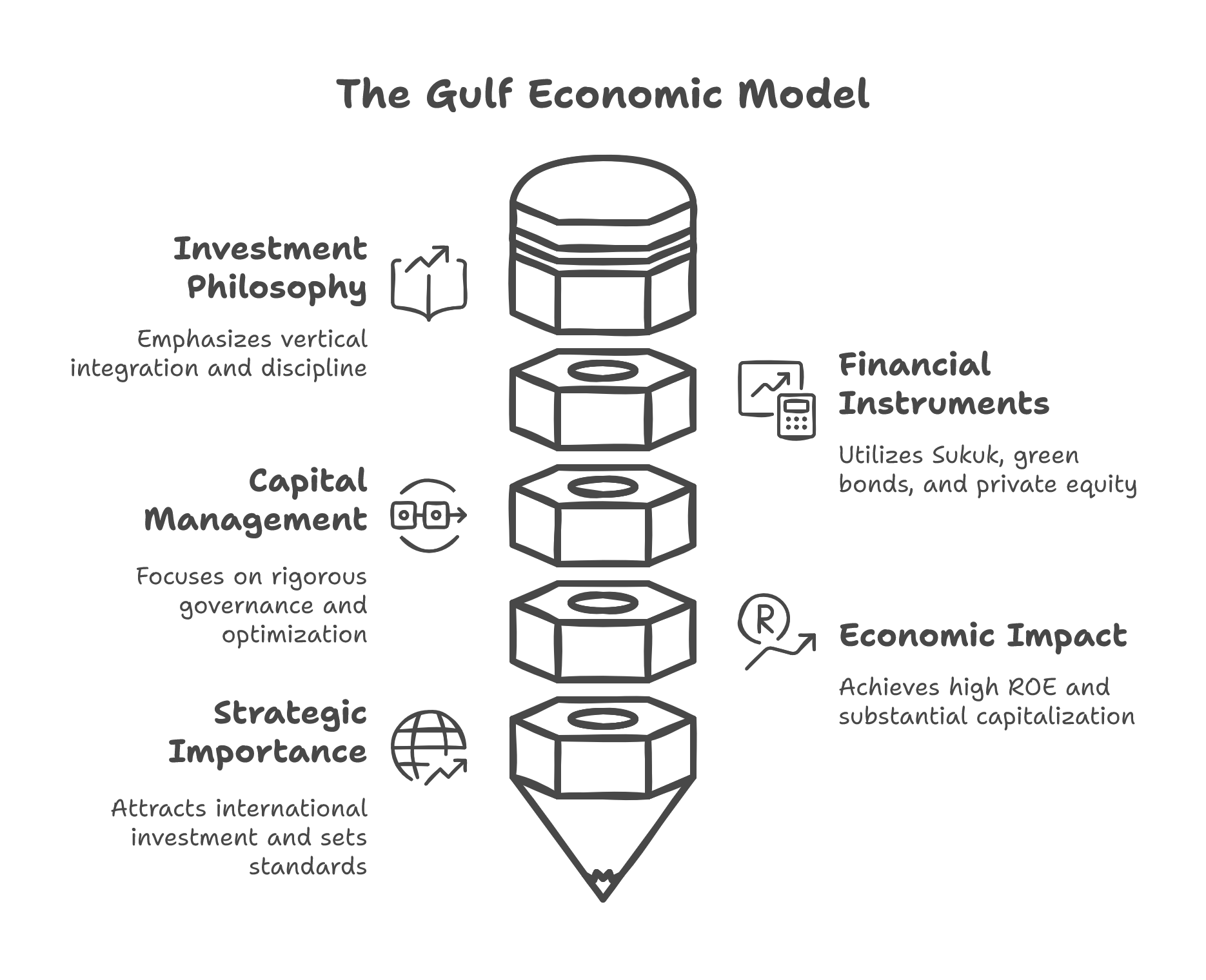

Unlike Western models that favor extensive diversification to spread risk, Gulf conglomerates opt for a sharp concentration in high-potential sectors. This approach allows for:

- Complete vertical integration, providing direct control over the production and distribution chain.

- Optimization of internal synergies, which facilitates cost reduction and margin improvement.

- Efficient capital allocation, achieved through targeted financing and well-managed leverage strategies.

These mechanisms translate into controlled financial ratios and a hybrid capital structure. On average, these groups exhibit a financing mix of approximately 40% equity, 30% long-term debt, and 30% external funding (sovereign funds and private equity). This structure not only minimizes financial risk but also supports robust organic growth, with return on equity (ROE) typically ranging between 15% and 20%.

II. Sectoral and Financial Analysis by Country

A. United Arab Emirates – Real Estate and Retail as Pillars of Growth

Majid Al Futtaim Group (MAF)

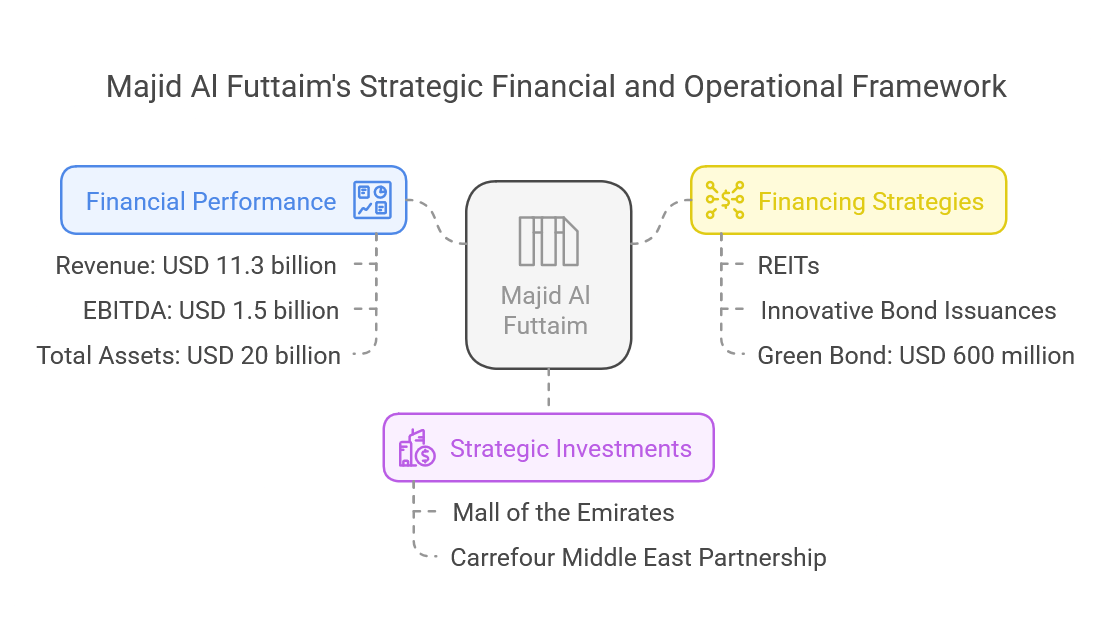

Majid Al Futtaim stands as a prime example of strategic concentration. In 2023, the group recorded:

- Revenue: Approximately USD 11.3 billion

- EBITDA: USD 1.5 billion

- Total Assets: Nearly USD 20 billion

MAF’s strategy is rooted in massive investments in commercial real estate and retail, with flagship assets such as the Mall of the Emirates and a strong presence in partnership with Carrefour Middle East. Its financing is optimized through mechanisms like REITs and innovative bond issuances, including a USD 600 million green bond issued in 2022, ensuring competitive cost of capital and refinancing flexibility.

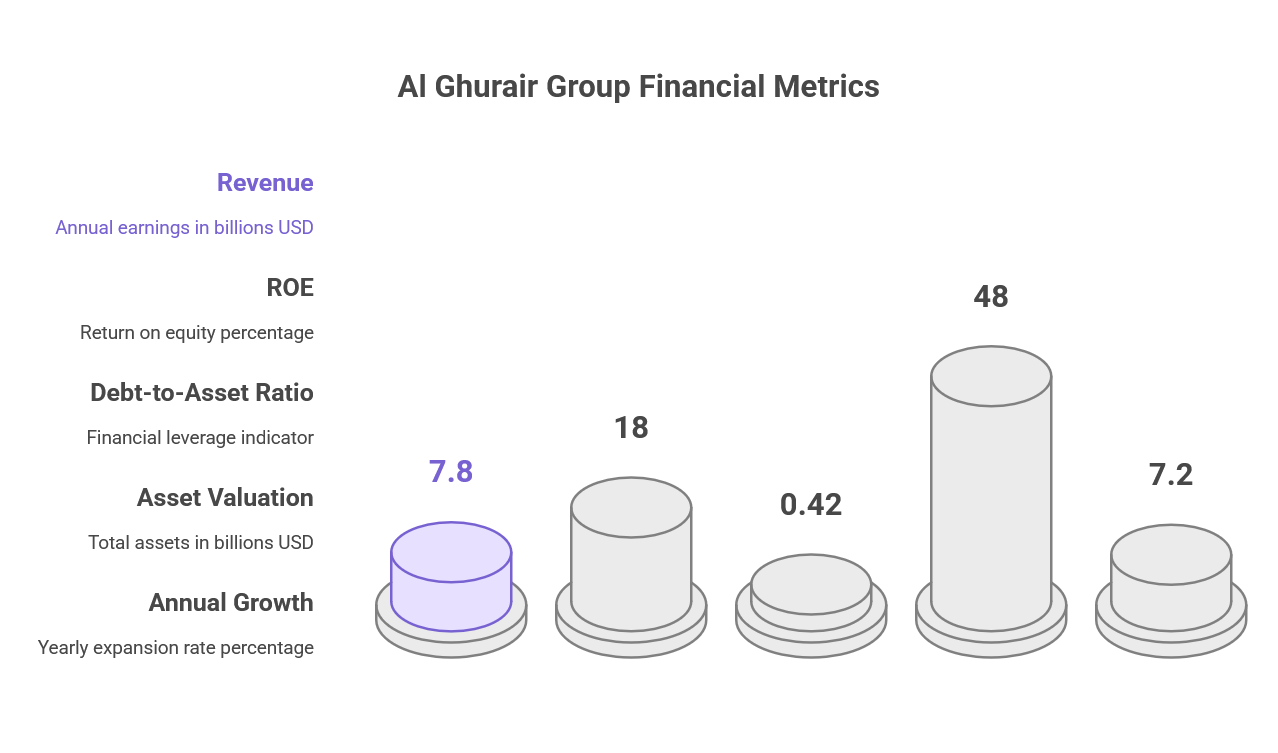

Al Ghurair Group

With revenue of USD 7.8 billion and an ROE of 18%, Al Ghurair Group illustrates the effectiveness of a vertically integrated model in key sectors:

- Debt-to-Asset Ratio: 0.42

- Asset Valuation: Approximately USD 48 billion

- Annual Growth: Around 7.2%

By integrating its value chain—such as through the acquisition of strategic entities like Dubai Investments Industries—the group manages to control its margins and reinforce its regional market position.

B. Saudi Arabia – Energy, Automotive, and Private Equity at the Core of Performance

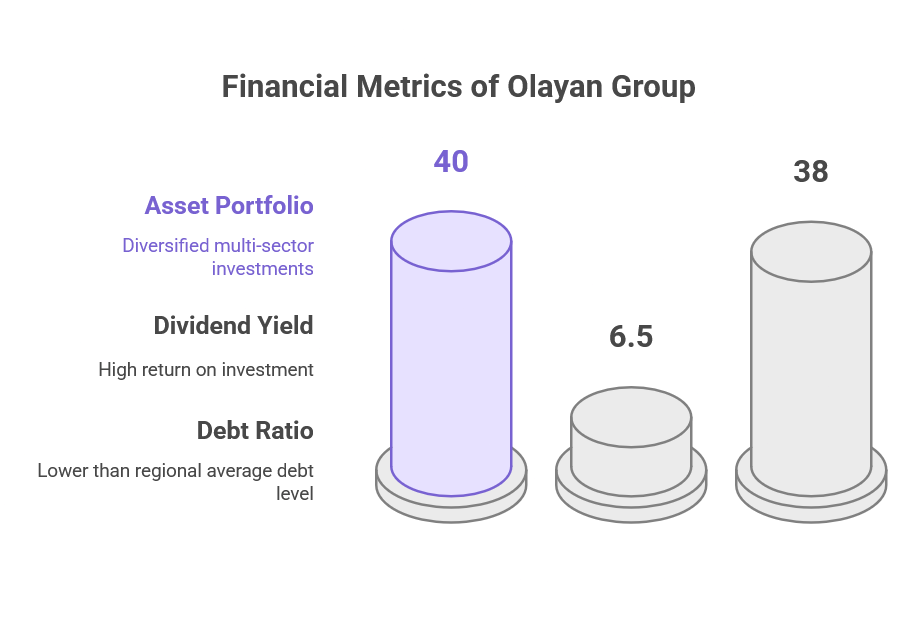

Olayan Group

Olayan Group distinguishes itself with a multi-sector strategy focused on energy, financial services, and private equity:

- Asset Portfolio: Approximately USD 40 billion

- Dividend Yield: 6.5%

- Debt Ratio: Around 38% (notably lower than the regional average of 45–50%)

Olayan strategically invests in both fossil and renewable energy while diversifying risk through stakes in international financial institutions such as Morgan Stanley and Credit Suisse. This positioning ensures stable growth and attractive returns.

Abdul Latif Jameel

A leader in automotive distribution, partnering with brands like Toyota, Lexus, and Ford, Abdul Latif Jameel reports:

- Revenue: USD 9.5 billion

- Equity: USD 28 billion

To finance its expansion—particularly into renewable energy—the group executed a USD 2 billion bond issuance in 2023, further reinforcing its sustainable growth profile.

C. Qatar – Luxury, High-End Real Estate, and Sukuk Financing

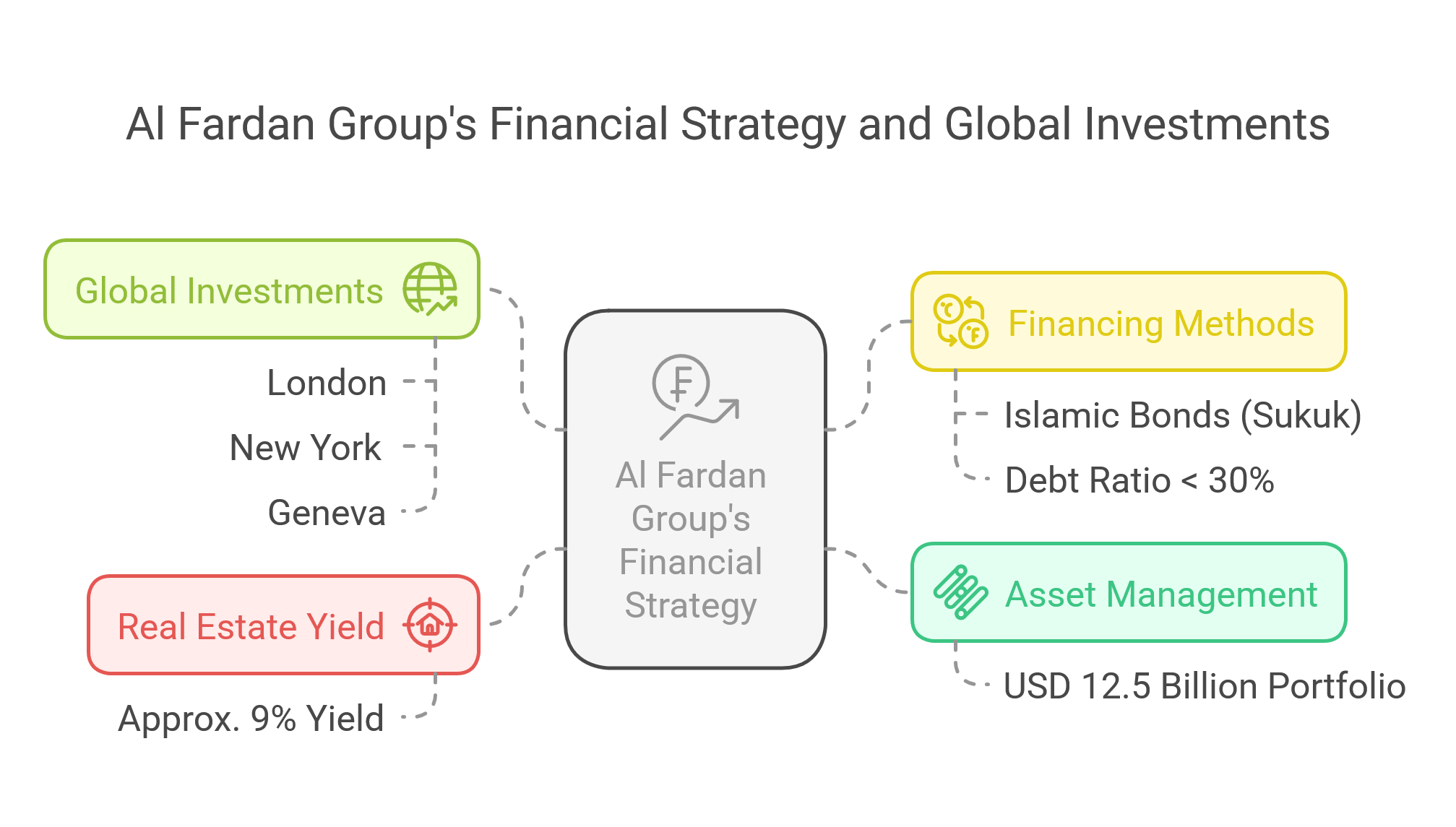

Al Fardan Group

Focusing on luxury real estate and private banking, Al Fardan Group manages an asset portfolio estimated at USD 12.5 billion:

- Targeted Real Estate Yield: Approximately 9%

- Financed through Islamic bonds (Sukuk), maintaining a debt ratio below 30%

- Strategic investments in international hubs such as London, New York, and Geneva, enhancing global visibility.

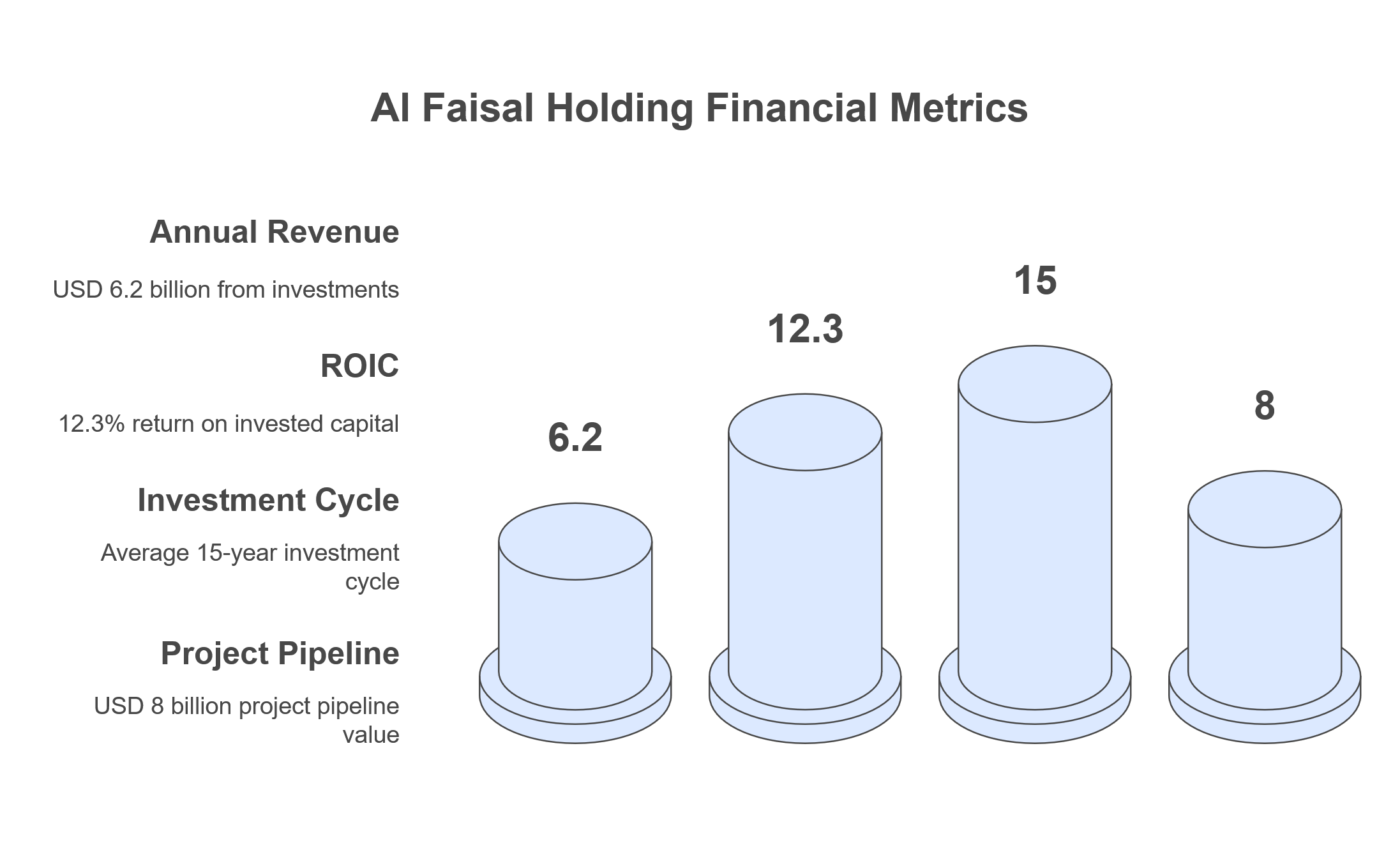

Al Faisal Holding

With a patient capital approach, Al Faisal Holding concentrates on infrastructure and industrial investments, posting:

- Annual Revenue: USD 6.2 billion

- Return on Invested Capital (ROIC): 12.3%

- An average investment cycle of 15 years and a project pipeline valued at around USD 8 billion, ensuring long-term sustainable growth.

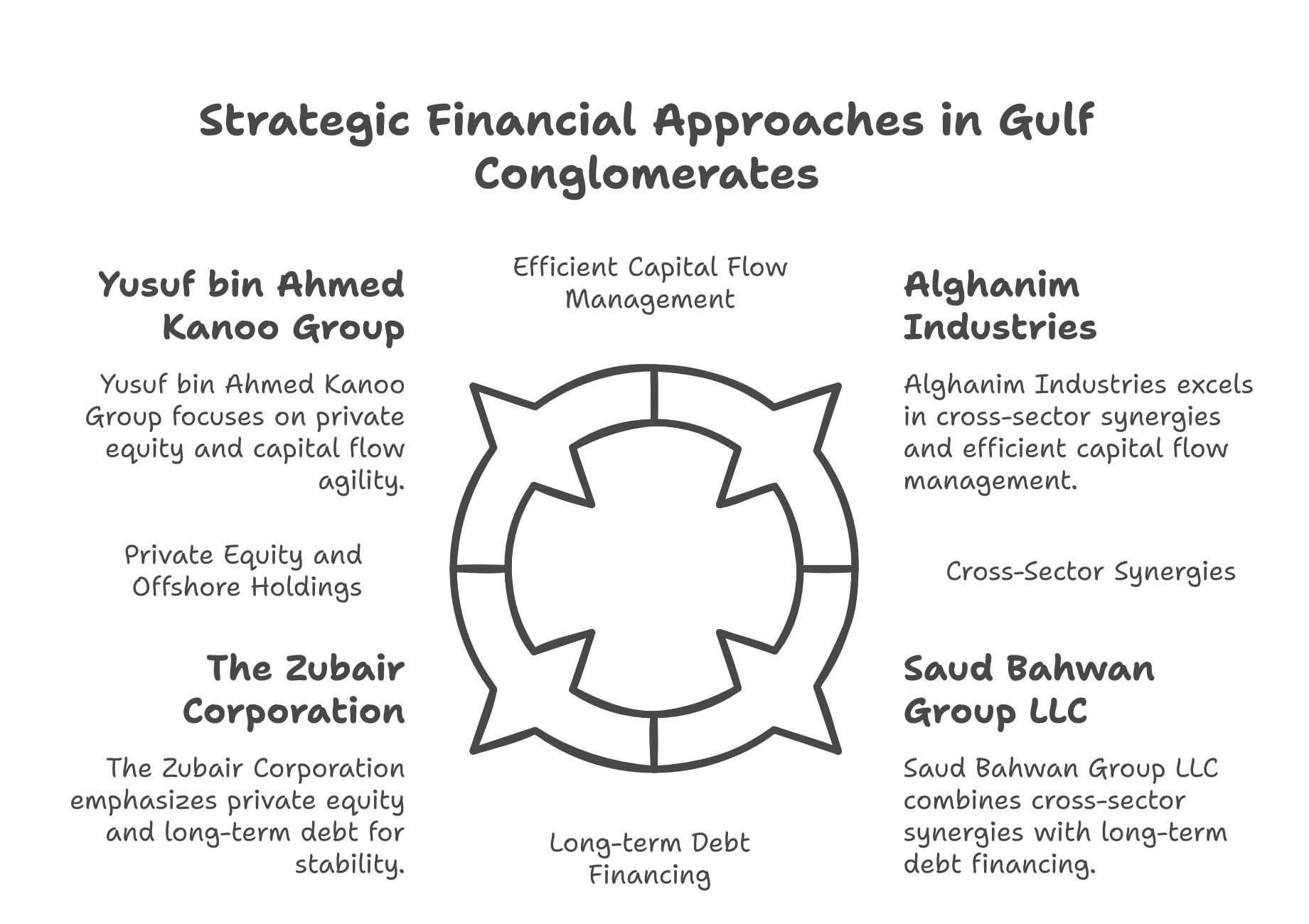

D. Kuwait, Oman, and Bahrain – Mastery Over Capital Flows and Cross-Sector Synergies

In Kuwait, groups like Alghanim Industries focus on the automotive, consumer electronics, and high-end distribution sectors, creating cross-sector synergies that optimize margins while maintaining competitive debt ratios.

In Oman, conglomerates such as Saud Bahwan Group LLC and The Zubair Corporation leverage long-term debt financing and fiscal optimization measures to support large-scale industrial and energy projects, consistently delivering stable long-term performance.

In Bahrain, the Yusuf bin Ahmed Kanoo Group and its counterparts rely on private equity structures and offshore holdings to orchestrate international distribution and commercial real estate ventures, ensuring efficient management of capital flows with agility and precision.

III. Financial Governance and Capital Optimization

The 30 Family Businesses of the Middle East .The financial governance of these conglomerates is based on highly sophisticated capital management mechanisms. Key aspects include:

- Hybrid Financing Structures: Typically composed of around 40% equity, 30% long-term debt, and 30% external funding, balancing risk and profitability.

- Reinvestment Strategies: Dividend payout ratios are generally capped at 50%, ensuring that the majority of earnings are reinvested in high-potential projects.

- Tax Optimization: The use of low-tax jurisdictions (notably Dubai and Bahrain) facilitates profit retention and optimizes capital flows, enhancing international competitiveness.

- Advanced Financial Instruments: The utilization of Sukuk, green bonds, and private equity structures enables access to competitive financing rates and diversified capital sources, all while maintaining controlled leverage.

IV. The Middle East: A New Global Strategic Epicenter

The emergence of the Middle East as a strategic hub is not limited to internal management practices but is also reinforced by a favorable global context:

- Substantial Sovereign Liquidity: Sovereign wealth funds such as the Saudi Public Investment Fund (valued at USD 750 billion) and the Abu Dhabi Investment Authority (with USD 875 billion in assets) provide a robust financial foundation that supports strategic investments.

- Favorable Tax and Currency Environments: With extremely low or even zero corporate tax rates and currencies indexed to the dollar, the region offers a stable and attractive environment for international investors.

- Attraction of Foreign Investment: The concentration of high-value assets and exemplary financial governance draw global investors looking to secure capital in an era of worldwide volatility.

This confluence of factors positions the Middle East not only as a zone of robust growth but also as a veritable laboratory for financial innovation and strategic sector concentration—where every investment is meticulously calibrated to maximize long-term value creation.

Conclusion

I. United Arab Emirates (UAE)

- Gargash Group

- Primary Sectors: Automotive, real estate, and financial services

- Technical Insights:

- Integration & Synergy: Employs vertical integration across distribution and service networks to optimize operating margins.

- Capital Structure: Leverages a blend of short- and long-term debt with an average gearing ratio of around 1.2x EBITDA.

- Expert Commentary: Their strategic focus on high-margin segments in the automotive sector, coupled with real estate asset recycling, provides robust free cash flow generation.

- Al Masaood

- Primary Sectors: Automotive, industrial distribution

- Technical Insights:

- Strategic Partnerships: Forms long-term strategic alliances with OEMs, leveraging fixed asset financing and contractual revenue models.

- Financial Metrics: Consistent ROE in the 16–18% range, supported by conservative liquidity management.

- Expert Commentary: Their focused sector engagement and rigorous vendor management have allowed them to maintain competitive EBITDA margins despite market cyclicality.

- Majid Al Futtaim

- Primary Sectors: Commercial real estate, retail

- Technical Insights:

- Asset Utilization: Operates flagship properties (e.g., Mall of the Emirates) financed partly via REIT structures; maintains debt-to-equity below 1.0x.

- Financing Innovations: Pioneered the use of green bonds (USD 600 million issuance in 2022) to support sustainable asset expansion.

- Expert Commentary: Their model of leveraging high-value real estate assets with structured financing underpins a resilient cash flow profile and long-term capital appreciation.

- مجموعة الفهيم (Al Faheem Group)

- Primary Sectors: Automotive, real estate, distribution

- Technical Insights:

- Operational Focus: Emphasizes operational consolidation over diversification, ensuring streamlined cost management.

- Capital Efficiency: Demonstrates robust asset turnover ratios, reflecting a tightly managed capital base with lean operations.

- Expert Commentary: By avoiding over-diversification, they enhance strategic focus and maintain higher profit margins through integrated supply chains.

- Al Ghurair Group

- Primary Sectors: Industrial manufacturing, real estate, consumer distribution

- Technical Insights:

- Vertical Integration: Achieves full-chain control from raw material procurement to retail, driving economies of scale.

- Financial Performance: Reports an ROE of approximately 18% with a debt-to-assets ratio of 0.42.

- Expert Commentary: Their strategy of acquiring complementary businesses (e.g., Dubai Investments Industries) enhances operational synergy and margin sustainability.

II. Saudi Arabia

- The Olayan Group

- Primary Sectors: Energy, financial services, high-end real estate

- Technical Insights:

- Investment Model: Uses a dual approach—direct investments in traditional energy alongside strategic private equity stakes in financial institutions.

- Risk Management: Maintains an asset portfolio around USD 40 billion with a dividend yield of 6.5% and a conservative debt ratio near 38%.

- Expert Commentary: Their disciplined capital allocation and risk-adjusted returns strategy provide stability amid global energy volatility.

- Juffali

- Primary Sectors: Automotive, engineering

- Technical Insights:

- Technology Adoption: Invests heavily in digital transformation and smart manufacturing, driving operational efficiencies.

- Financial Leverage: Maintains moderate leverage with an emphasis on return on invested capital (ROIC) exceeding 14%.

- Expert Commentary: Their focus on integrating cutting-edge technologies into legacy sectors has allowed them to innovate and sustain competitive advantage.

- Ajlan & Bros Holding

- Primary Sectors: Fashion retail, textiles, real estate

- Technical Insights:

- Operational Efficiency: Concentrates on streamlined supply chain integration and targeted capital allocation, keeping overhead costs low.

- Financial Discipline: Demonstrates consistent EBITDA margins above industry averages with an emphasis on reinvesting retained earnings.

- Expert Commentary: By focusing on core sectors and leveraging brand equity, they drive steady performance even in volatile consumer markets.

- Abdul Latif Jameel

- Primary Sectors: Automotive distribution, financial services, renewable energy

- Technical Insights:

- Vertical Integration: Controls the entire distribution network for major international automotive brands.

- Debt Instruments: Successfully executed a USD 2 billion bond issuance in 2023, supporting expansion into renewable sectors.

- Expert Commentary: Their strategic blend of traditional automotive strengths with emerging renewable investments creates a balanced portfolio poised for future growth.

- Al Muhaidib Group

- Primary Sectors: Agro-industrial, real estate, consumer products

- Technical Insights:

- Long-Term Orientation: Engages in multi-decade projects with steady dividend policies, ensuring long-term capital appreciation.

- Asset Allocation: Carefully structured portfolio with a focus on low volatility and high operational cash flow.

- Expert Commentary: Their commitment to long-term investments in infrastructure and consumer markets underpins sustainable growth even during economic downturns.

III. Qatar

- Al Fardan Group

- Primary Sectors: Luxury real estate, private banking

- Technical Insights:

- Capital Markets: Leverages Sukuk financing to maintain a debt ratio below 30%, ensuring cost-effective capital access.

- Global Footprint: Investments in strategic international hubs (London, New York, Geneva) yield target returns near 9%.

- Expert Commentary: Their precise use of Islamic finance instruments enables both compliance and competitive edge in global capital markets.

- Al Faisal Holding

- Primary Sectors: Infrastructure, industrial projects

- Technical Insights:

- Investment Horizon: Operates on a long-cycle investment model (average cycle of 15 years) with a robust pipeline valued at approximately USD 8 billion.

- Return Metrics: Achieves a ROIC of around 12.3%, reflective of disciplined asset management.

- Expert Commentary: Their patient capital approach and integrated project financing enhance value creation in capital-intensive industries.

- Almana Group

- Primary Sectors: Retail, automotive

- Technical Insights:

- Operational Integration: Implements full-chain operational integration, leading to improved margins and reduced transaction costs.

- Performance Metrics: Consistently high EBIT margins due to centralized management and streamlined distribution channels.

- Expert Commentary: Focused integration across segments ensures robust performance even when external market conditions fluctuate.

- ABUISSA HOLDING

- Primary Sectors: Transport, logistics

- Technical Insights:

- Operational Efficiency: Invests in advanced logistics technologies to optimize supply chain efficiency and asset utilization.

- Capital Efficiency: Maintains a low capital intensity ratio, maximizing turnover in a capital-light model.

- Expert Commentary: Their strategic focus on operational excellence in logistics positions them for long-term growth in an increasingly interconnected global economy.

- Almuftah Group Qatar

- Primary Sectors: Construction, real estate, retail distribution

- Technical Insights:

- Project Financing: Utilizes structured finance mechanisms to manage large-scale projects, ensuring steady cash flow and low refinancing risk.

- Scalability: Demonstrates scalable operations through repeatable project management models.

- Expert Commentary: Their systematic approach to capital allocation in infrastructure projects underpins sustainable and predictable growth.

IV. Kuwait

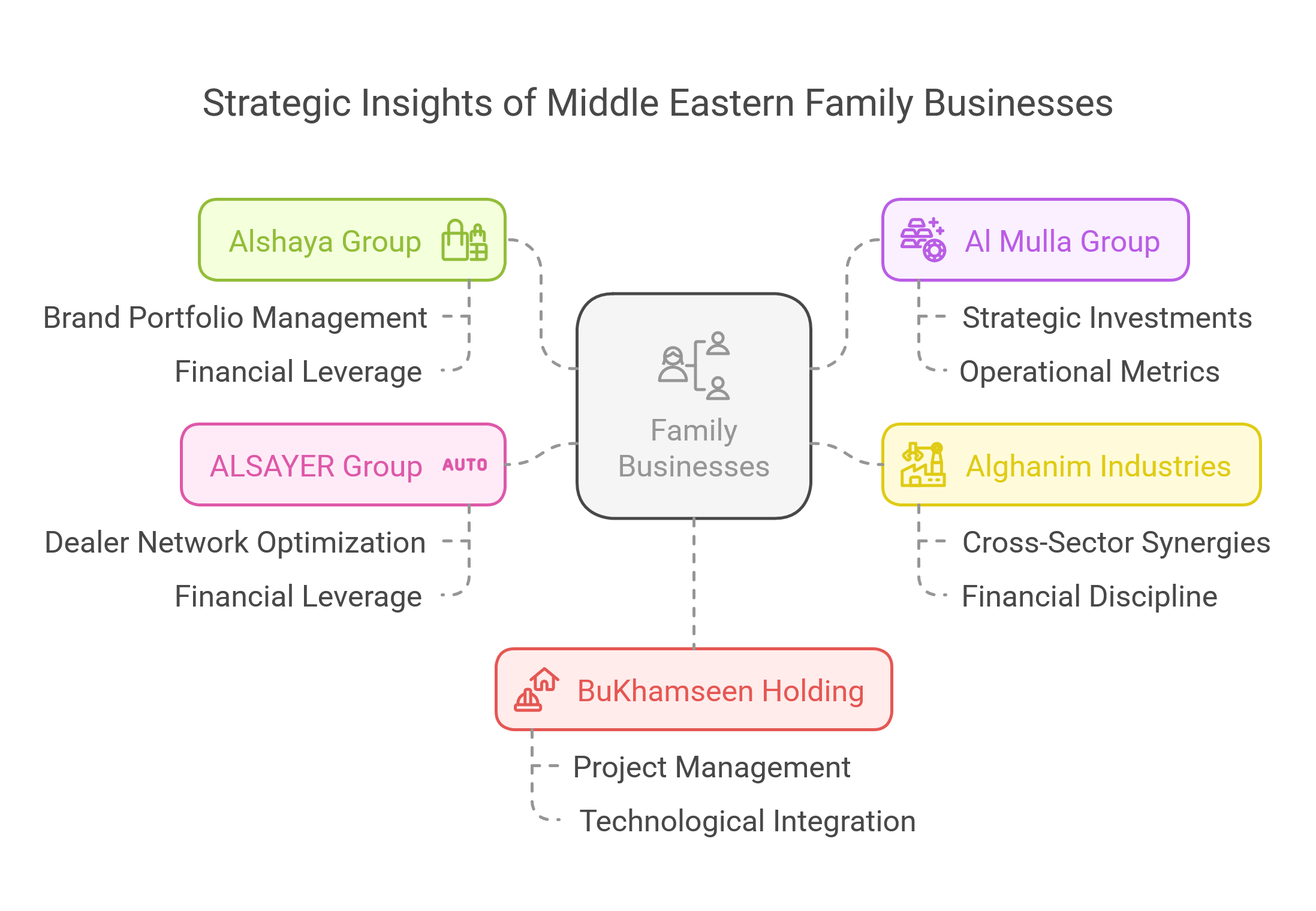

- Alshaya Group

- Primary Sectors: International retail distribution

- Technical Insights:

- Brand Portfolio Management: Manages a diversified portfolio of leading global brands (e.g., Starbucks, H&M) using centralized procurement and logistics systems.

- Financial Leverage: Uses sophisticated asset-liability management techniques to optimize working capital and liquidity.

- Expert Commentary: Their tight control over brand integration and distribution provides strong competitive differentiation and high EBITDA margins.

- Al Mulla Group

- Primary Sectors: Automotive, retail, financial services

- Technical Insights:

- Strategic Investments: Focuses on high-yield sectors with low cyclicality; employs risk-adjusted capital allocation strategies.

- Operational Metrics: Consistently high operating margins, driven by streamlined operations and a robust governance framework.

- Expert Commentary: Their concentrated investment model, combined with prudent financial management, underpins steady, long-term growth.

- Alghanim Industries

- Primary Sectors: Consumer electronics, automotive, real estate

- Technical Insights:

- Cross-Sector Synergies: Integrates supply chain efficiencies across diverse divisions, resulting in a high asset turnover ratio and controlled cost structures.

- Financial Discipline: Maintains a balanced capital structure with competitive debt servicing metrics.

- Expert Commentary: Their model of strategic concentration allows for consistent operational performance and margin improvement across multiple high-demand sectors.

- ALSAYER Group

- Primary Sectors: Automotive import and distribution

- Technical Insights:

- Dealer Network Optimization: Uses data-driven strategies to optimize distribution channels and minimize inventory costs.

- Financial Leverage: Implements targeted debt financing strategies to expand market share without diluting equity.

- Expert Commentary: Their strategic focus on building deep partnerships with global automotive brands enables them to command premium margins in a competitive market.

- BuKhamseen Holding

- Primary Sectors: Construction, real estate development

- Technical Insights:

- Project Management: Employs advanced project finance techniques to fund large-scale developments while ensuring robust IRRs.

- Technological Integration: Leverages BIM (Building Information Modeling) and other tech innovations to reduce project risk and optimize delivery.

- Expert Commentary: Their rigorous approach to capital allocation and technological integration has positioned them as a leader in high-value, asset-intensive projects.

V. Oman

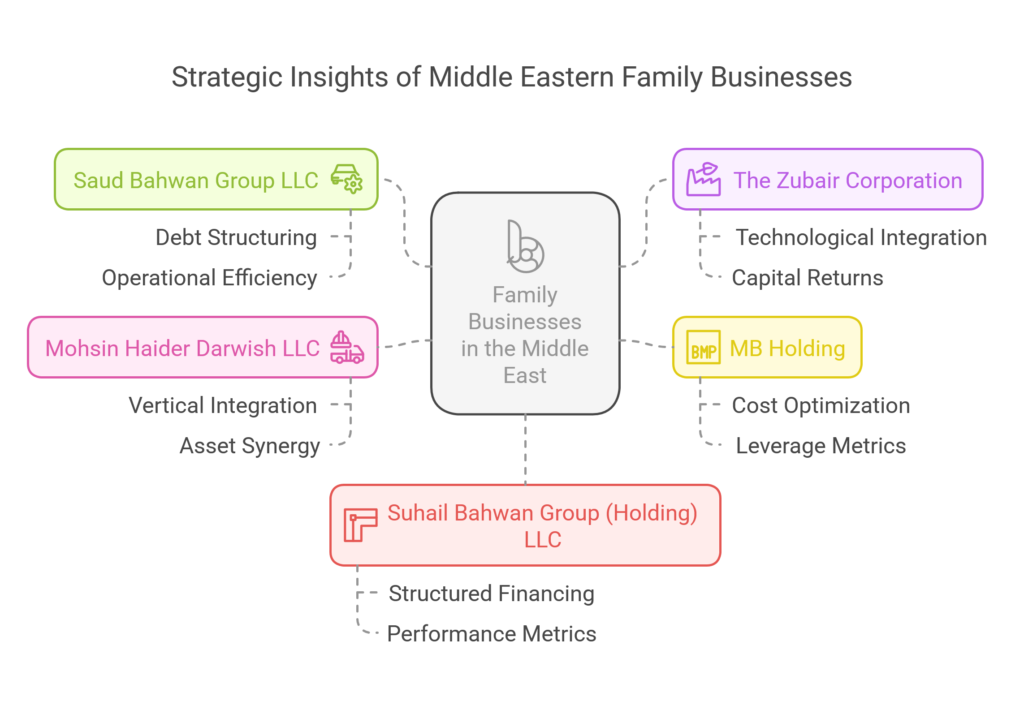

- Saud Bahwan Group LLC

- Primary Sectors: Automotive, industrial equipment

- Technical Insights:

- Debt Structuring: Utilizes long-term, low-cost debt instruments to finance infrastructure projects, maintaining a conservative debt-to-EBITDA ratio.

- Operational Efficiency: Leverages economies of scale in procurement and distribution for consistent cash flow generation.

- Expert Commentary: Their focus on high-capex industries, supported by disciplined financial management, creates a robust foundation for sustainable growth.

- The Zubair Corporation

- Primary Sectors: Energy, construction, financial services

- Technical Insights:

- Technological Integration: Implements cutting-edge construction technologies and energy-efficient processes to drive operational savings.

- Capital Returns: Focuses on projects with high IRRs and stable cash flows, supported by strategic project financing.

- Expert Commentary: Their dynamic integration of technology and finance allows them to capture value in traditionally capital-intensive sectors.

- MB Holding

- Primary Sectors: Oil & gas

- Technical Insights:

- Cost Optimization: Drives cost efficiencies through rigorous operational discipline and technology integration in upstream and downstream operations.

- Leverage Metrics: Maintains a moderate debt ratio to support capital expenditures while preserving shareholder value.

- Expert Commentary: Their resilient business model in a cyclical sector is underpinned by strong financial controls and proactive cost management.

- Mohsin Haider Darwish LLC

- Primary Sectors: Construction, automotive, electrical equipment

- Technical Insights:

- Vertical Integration: Controls key components of the supply chain to minimize input costs and enhance operational margins.

- Asset Synergy: Achieves cross-functional efficiencies that drive both revenue and EBITDA growth.

- Expert Commentary: Their disciplined integration strategy enables them to extract maximum value from every segment, ensuring robust financial performance.

- Suhail Bahwan Group (Holding) LLC

- Primary Sectors: Automotive, industrial equipment

- Technical Insights:

- Structured Financing: Utilizes project finance and syndicated loans to underpin expansion in competitive markets.

- Performance Metrics: Demonstrates solid ROE through a combination of operational excellence and financial leverage control.

- Expert Commentary: Their blend of strategic financial planning with market penetration in capital-intensive industries positions them for sustained long-term returns.

VI. Bahrain

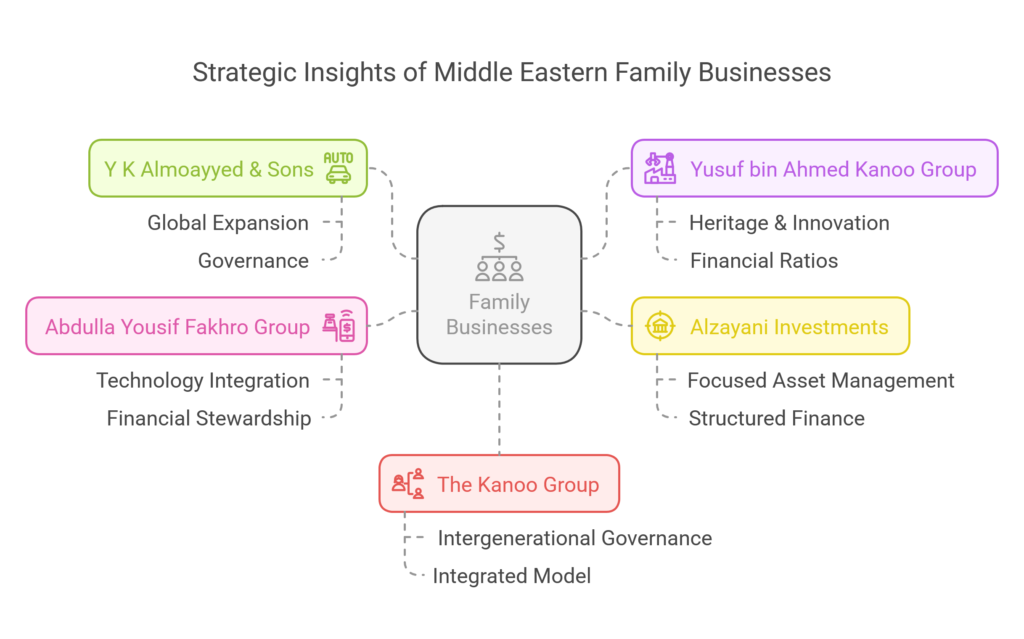

- Y K Almoayyed & Sons (B.S.C)

- Primary Sectors: Automotive distribution, consumer goods

- Technical Insights:

- Global Expansion: Employs a multi-regional strategy supported by private equity structures and advanced cash flow modeling.

- Governance: Maintains rigorous internal controls to optimize operating margins and sustain high dividend payouts.

- Expert Commentary: Their internationally oriented business model and strong governance framework secure their competitive position in high-value markets.

- Yusuf bin Ahmed Kanoo Group

- Primary Sectors: Automotive, real estate, financial services

- Technical Insights:

- Heritage & Innovation: Combines a long legacy with modern financial instruments, including off-balance-sheet financing to optimize capital usage.

- Financial Ratios: Consistently achieves ROE in the upper teens, with stable revenue streams across sectors.

- Expert Commentary: Their blend of traditional values and innovative financial strategies provides a sustainable competitive advantage in a shifting economic landscape.

- Alzayani Investments

- Primary Sectors: Automotive, construction, real estate

- Technical Insights:

- Focused Asset Management: Implements advanced asset valuation techniques and risk-adjusted return models to maximize portfolio performance.

- Structured Finance: Uses a mix of debt instruments and equity participation to balance risk and growth.

- Expert Commentary: Their precise capital allocation and robust financial planning ensure they maintain competitive margins and scalable growth.

- Abdulla Yousif Fakhro Group

- Primary Sectors: Consumer goods distribution, automotive

- Technical Insights:

- Technology Integration: Leverages digital platforms for supply chain optimization and cost reduction.

- Financial Stewardship: Maintains disciplined cost controls with consistent operating margins exceeding industry benchmarks.

- Expert Commentary: Their focus on innovation and efficient capital utilization positions them well to capitalize on shifting consumer trends while ensuring financial robustness.

- The Kanoo Group

- Primary Sectors: Real estate, transportation, distribution

- Technical Insights:

- Intergenerational Governance: Combines decades of experience with modern corporate governance practices, including strategic use of offshore holdings to optimize tax and capital structures.

- Integrated Model: Leverages vertical integration to control end-to-end operations, ensuring high operational efficiency and asset liquidity.

- Expert Commentary: As one of the region’s oldest conglomerates, The Kanoo Group exemplifies resilience through strategic reinvestment and robust capital management, positioning it as a benchmark for sustainable growth in a globally dynamic environment.

Each of these family offices demonstrates a sophisticated, concentrated investment philosophy that emphasizes vertical integration, rigorous financial discipline, and strategic capital allocation. Their success lies in the ability to adapt advanced financial instruments—ranging from Sukuk and green bonds to sophisticated private equity models—while maintaining a laser-focused approach on high-value sectors, ensuring both operational excellence and long-term value creation.

The 30 Family Businesses of the Middle East represent far more than traditional enterprises. They embody an innovative, concentrated economic model based on rigorous financial governance, exemplary capital flow management, and deep vertical integration. With ROE typically between 15% and 20%, controlled leverage, and a cumulative capitalization exceeding USD 1 trillion, these conglomerates have demonstrated their capacity to transform economic challenges into long-term growth opportunities.

In a world marked by global uncertainty and geopolitical shifts, the Gulf model emerges as the new strategic economic epicenter—capable of attracting international investment and setting the standards for long-term financial success. For astute investors and strategic decision-makers, understanding and leveraging this model is essential for navigating the economy of tomorrow.