USD 685,230 per Adult and USD 18 Trillion in Losses When Schweizer Exzellenz Defies the Global Order

USD 685,230 per Adult and USD 18 Trillion in Losses When Schweizer Exzellenz Defies the Global Order

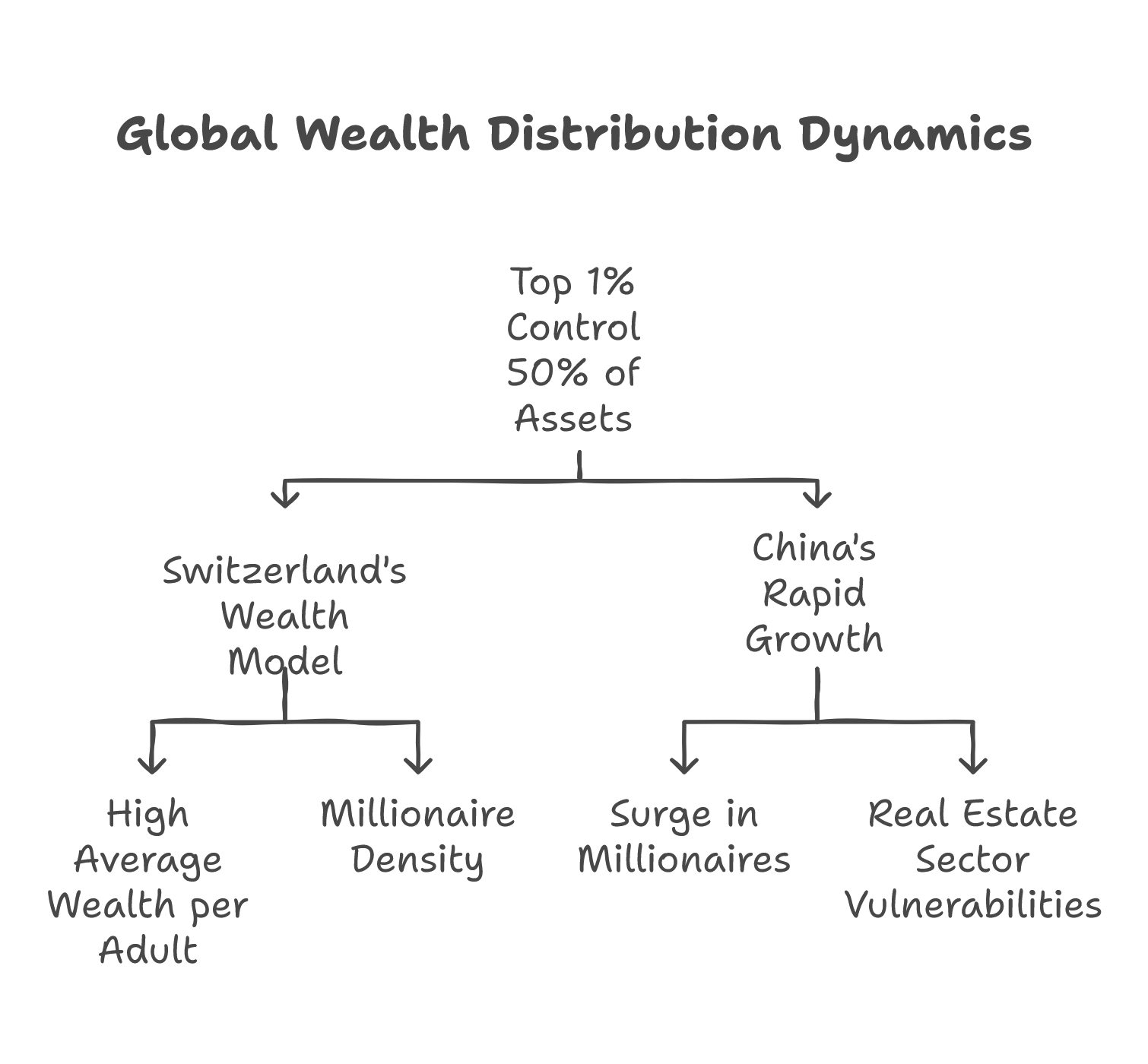

The global economy is evolving at a breakneck pace, continuously redefining the balance of power and wealth. Recent studies reveal that the top 1% of adults now control nearly 50% of global assets—a level of concentration that influences approximately 46.8 million millionaires worldwide. These figures underscore deep-seated structural inequalities and highlight the systemic risks associated with an uneven distribution of resources.

At the heart of this landscape stands Switzerland, boasting the world’s highest average wealth per adult at USD 685,230. With an exceptional density of millionaires—one in every six adults holds assets exceeding USD 1 million—Switzerland epitomizes economic stability and efficient capital management. This achievement is driven by a highly sophisticated banking sector, a globally renowned precision industry (notably in luxury watchmaking and pharmaceuticals), and a disciplined economic policy that consistently attracts substantial foreign investment. By contrast, although economies like the United States and Germany boast colossal aggregates of wealth, they often fall short in translating that wealth into a similarly uniform level of individual prosperity.

In stark contrast, China exhibits a radically different dynamic. The number of Chinese millionaires skyrocketed from 38,000 in 2010 to 4.4 million in 2019—a more than 100-fold increase in under a decade—enabling the country to boast approximately 100 million individuals in the global top 10% of wealth, surpassing the United States’ 99 million. However, this meteoric rise conceals significant structural vulnerabilities. The Chinese real estate sector—a key growth driver—has recorded a cumulative loss of USD 18 trillion over the past three years. This massive decline is attributed to excessive debt accumulation, asset overvaluation, and corrective measures that have fallen short of curbing rampant speculation. Such volatility starkly contrasts with Switzerland’s stable model, raising serious questions about the sustainability of growth strategies overly dependent on credit and speculative investments.

This article presents a detailed, data-driven analysis of global wealth distribution dynamics, focusing on two contrasting models: the Swiss paradigm—a beacon of rigor and excellence—and the volatile yet rapidly expanding Chinese model. By examining key indicators such as average wealth per adult, millionaire density, and the magnitude of real estate losses, we aim to shed light on the underlying mechanisms shaping wealth distribution in an increasingly unpredictable global economic landscape.

1. Global Wealth Distribution:

Capital Concentration and Structural Overview

- Wealth Concentration:

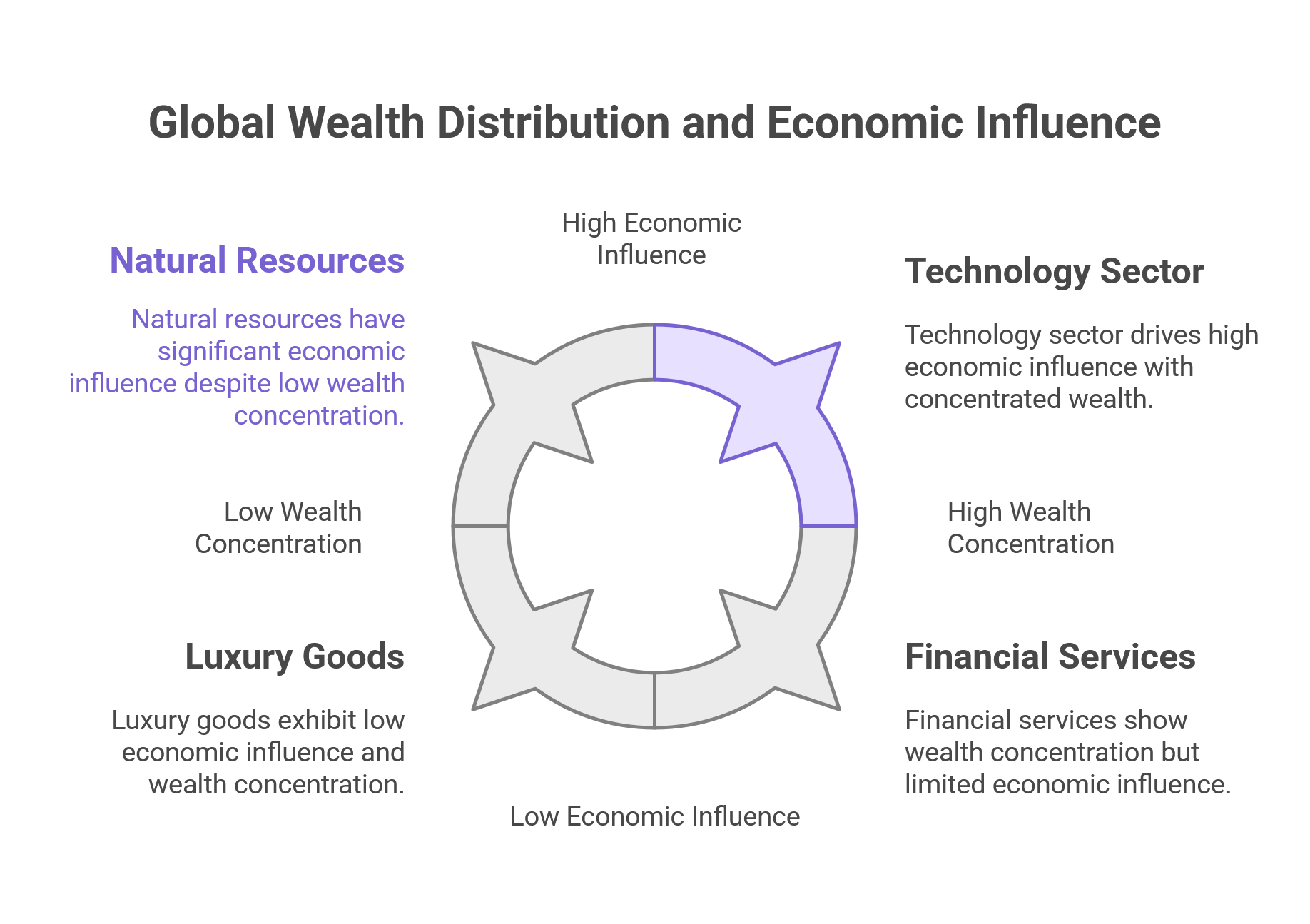

Recent reports confirm that the top 1% of adults controls nearly 50% of global assets. With roughly 46.8 million millionaires around the world, this concentration shapes market liquidity and risk—factors that are critical for investors evaluating systemic exposure. - Diverse Sectors and Regional Drivers:

Wealth is not distributed uniformly. Instead, it reflects local economic strengths: high-tech innovation, industrial manufacturing, luxury goods, natural resources, and financial services play varying roles across regions.

Country-Specific Details and Key Players

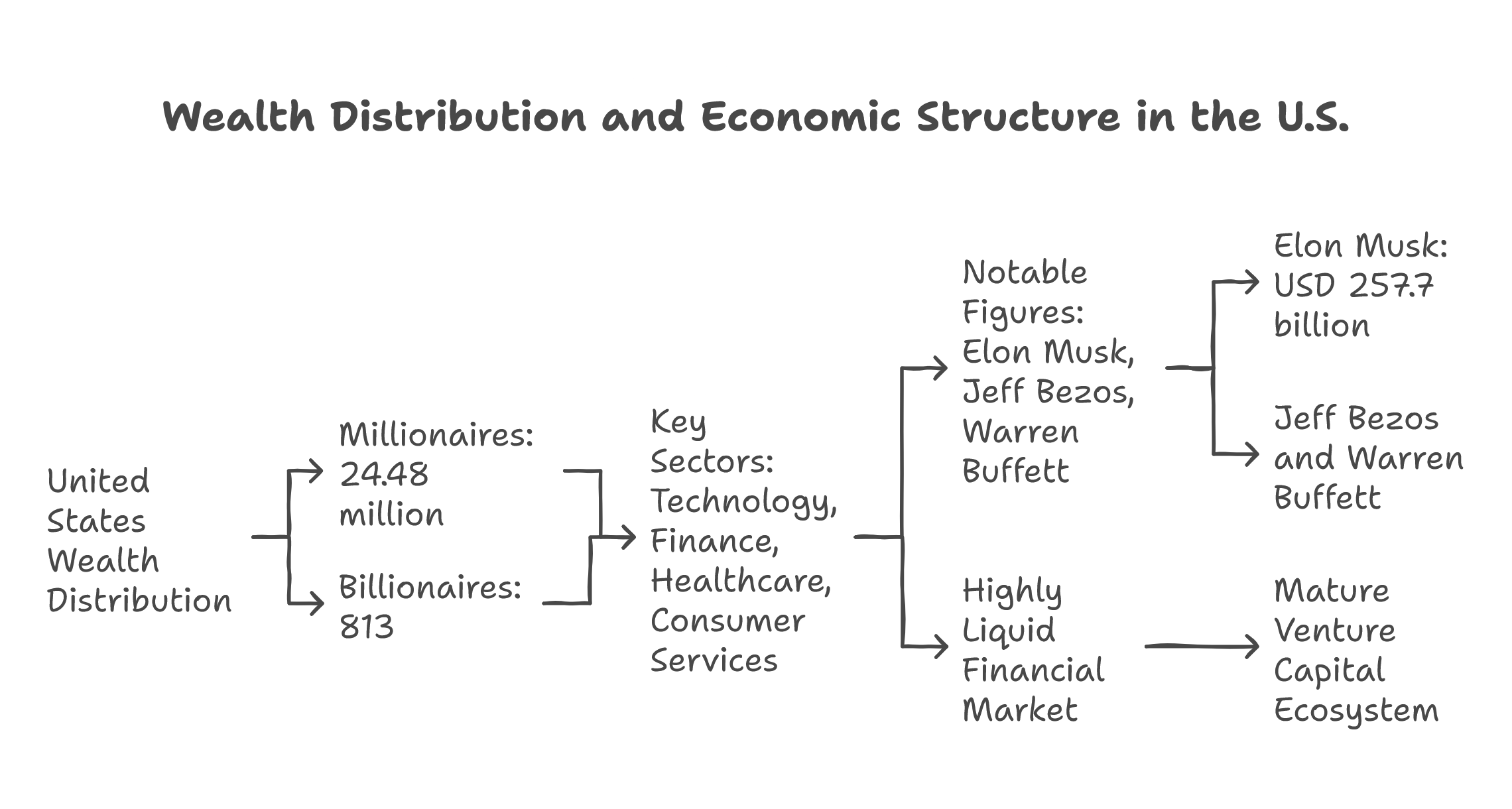

- United States:

- Millionaires: 24.48 million

- Billionaires: 813

- Key Sectors: Technology, finance, healthcare, and consumer services dominate.

- Notable Figures:

- Elon Musk (USD 257.7 billion) – exemplifies technological innovation and disruptive business models.

- Jeff Bezos and Warren Buffett (with multi-billion-dollar fortunes) further underscore the strength of diversified investments and market leadership.

- Additional Details: The U.S. benefits from a highly liquid financial market and a mature venture capital ecosystem that fuels continuous innovation and growth.

- China:

- Millionaires: 6.19 million

- Billionaires: 406

- Key Sectors: Manufacturing, technology, real estate, and consumer markets.

- Notable Figures:

- Zhong Shanshan (USD 43.4 billion) – a key figure in consumer products and pharmaceuticals.

- Pony Ma (founder of Tencent) and Robin Li (founder of Baidu) highlight the explosive growth in tech and internet sectors.

- Growth Dynamics: From 38,000 millionaires in 2010 to 4.4 million in 2019—a more than 100-fold increase—China’s rapid wealth creation is mirrored by an aggressive expansion in infrastructure and industrial capacity.

- Real Estate Concerns: However, structural weaknesses persist; the property market’s cumulative depreciation of USD 18 trillion over three years underscores the risk from excessive leverage and asset overvaluation, exemplified by high-profile developers like Evergrande.

- Japan:

- Millionaires: 3.366 million

- Billionaires: 41

- Key Sectors: Retail, precision manufacturing, and advanced robotics.

- Notable Figures:

- Tadashi Yanai (USD 42.8 billion) – his leadership of Fast Retailing (Uniqlo) represents Japan’s global influence in retail.

- Several major industrial conglomerates continue to support a steady wealth base despite demographic headwinds.

- Additional Details: Japan’s legacy of manufacturing excellence and innovation ensures its continued role as a global industrial powerhouse.

- United Kingdom:

- Millionaires: 2.849 million

- Billionaires: 55

- Key Sectors: Financial services, legal services, and professional services.

- Notable Figures:

- Prominent financiers and hedge fund managers, such as those from BlueCrest Capital Management, drive much of the country’s wealth.

- London remains one of the world’s premier financial centers despite geopolitical uncertainties like Brexit.

- Additional Details: The U.K. benefits from a strong regulatory framework and deep capital markets that continue to attract global investment.

- France:

- Millionaires: 2.796 million

- Billionaires: 53

- Key Sectors: Luxury goods, fashion, and aerospace.

- Notable Figures:

- Bernard Arnault (USD 191 billion) represents the high-margin luxury goods market through LVMH.

- Other industrial leaders and entrepreneurs in high-value sectors further cement France’s position.

- Additional Details: France’s reputation for quality and craftsmanship ensures its luxury brands remain highly profitable, driving overall wealth.

- Germany:

- Millionaires: 2.683 million

- Billionaires: 132

- Key Sectors: Engineering, automotive, industrial machinery, and logistics.

- Notable Figures:

- Klaus-Michael Kuehne (USD 39.2 billion) illustrates how deep industrial and logistics capabilities underpin substantial wealth.

- Germany’s robust export sector reinforces its economic resilience.

- Additional Details: Germany’s economic strength lies in its capacity to combine manufacturing prowess with innovation in technology and sustainability.

- Canada:

- Millionaires: 2.291 million

- Billionaires: 67

- Key Sectors: Natural resources, media, and technology.

- Notable Figures:

- The Thomson family (USD 67.8 billion) epitomizes success in media and diversified investments.

- Energy and mining sectors also contribute significantly to wealth creation.

- Additional Details: A stable political environment and resource wealth continue to bolster Canada’s economic prospects.

- Australia:

- Millionaires: 2.177 million

- Billionaires: 48

- Key Sectors: Mining, agriculture, and services.

- Notable Figures:

- Gina Rinehart (USD 30.8 billion) stands out as a leader in the mining industry.

- Other key players in natural resources and agribusiness contribute to a resilient wealth base.

- Additional Details: Australia’s wealth is closely tied to global commodity cycles and strategic trade relationships.

- Italy:

- Millionaires: 1.413 million

- Billionaires: 73

- Key Sectors: Agro-food, fashion, and industrial manufacturing.

- Notable Figures:

- Giovanni Ferrero (USD 43.8 billion) illustrates the power of brand valuation in the food sector.

- Legacy family businesses and artisanal producers continue to generate significant wealth.

- Additional Details: Italy’s mix of traditional industries and modern manufacturing creates a diversified, though regionally concentrated, wealth distribution.

- South Korea:

- Millionaires: 1.29 million

- Billionaires: 36

- Key Sectors: Semiconductors, electronics, and automotive.

- Notable Figures:

- Jay Y. Lee (USD 11.5 billion) from Samsung demonstrates the high-tech leadership driving South Korea’s wealth.

- Additional names in the technology and innovation sectors further support its global standing.

- Additional Details: South Korea’s aggressive investment in R&D and technology keeps it at the forefront of global innovation.

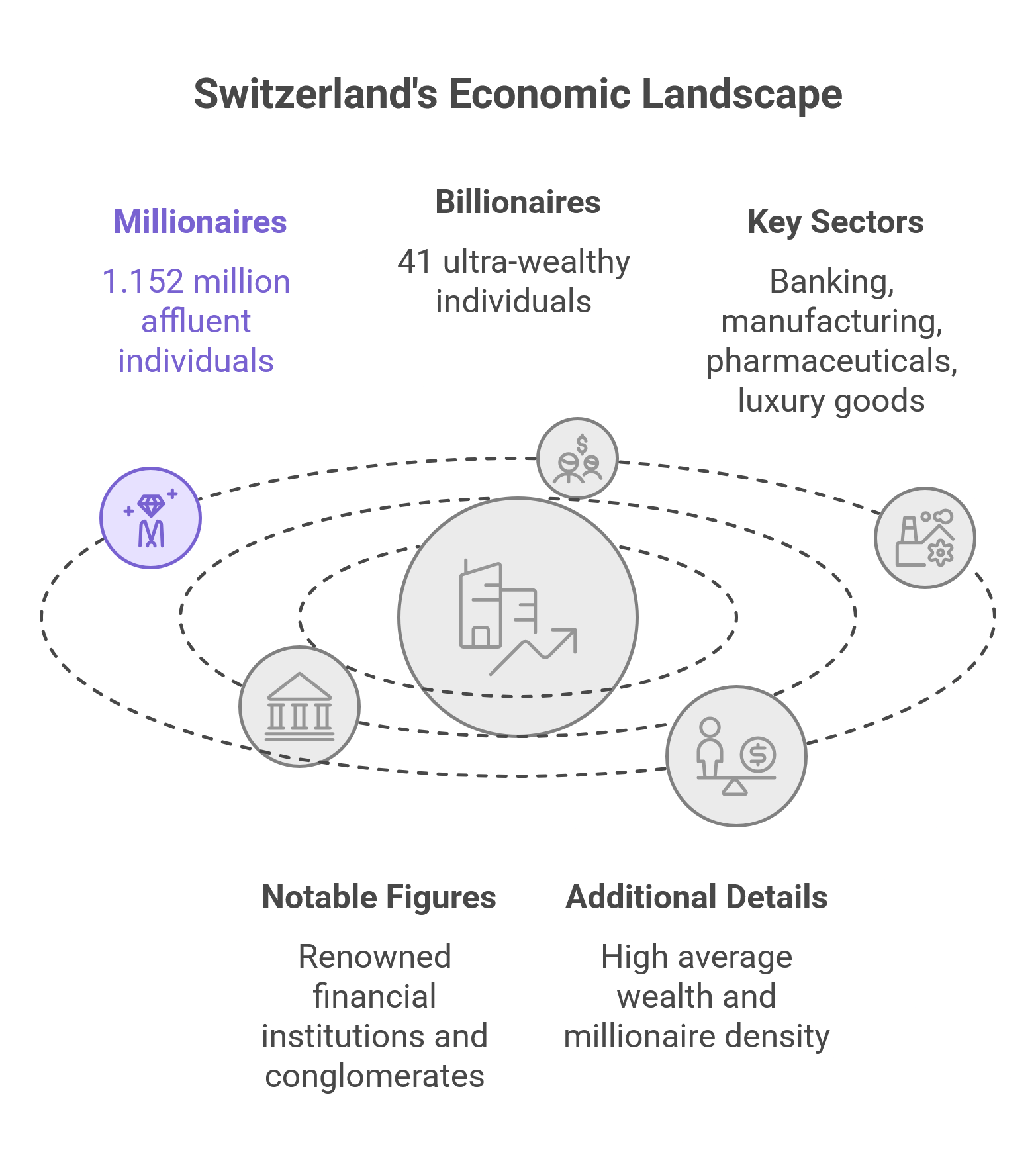

- Switzerland:

- Millionaires: 1.152 million

- Billionaires: 41

- Key Sectors: Banking, precision manufacturing, pharmaceuticals, and luxury goods.

- Notable Figures:

- Swiss financial institutions and conglomerates consistently rank among the most reliable in global finance.

- Additional Details: With a record average wealth per adult (USD 685,230) and a millionaire density of 1 in 6, Switzerland is a paragon of economic stability and efficient capital management.

- Other Notable Markets:

- Netherlands: With 1.149 million millionaires and 14 billionaires, driven by sectors like beverages and luxury goods (e.g., Charlene de Carvalho-Heineken, USD 14.1 billion).

- Spain: Boasting 1.132 million millionaires and 29 billionaires, anchored by retail giants like Amancio Ortega of Inditex (USD 103 billion).

- Taiwan: Home to 869,000 millionaires and 51 billionaires, powered by the technology sector (e.g., Barry Lam of Quanta Computer, USD 11 billion).

- India: Featuring 796,000 millionaires and 200 billionaires, with conglomerates like Reliance Industries (Mukesh Ambani, USD 116 billion) driving rapid wealth accumulation.

Countries ranked 16 through 30 (including Hong Kong, Sweden, Belgium, Denmark, Russia, New Zealand, Mexico, Saudi Arabia, Singapore, Austria, Indonesia, and Ireland) each have unique structural advantages that allow them to consolidate wealth despite regional challenges.

2. Focus on the Swiss Model: Technical Excellence and Operational Resilience

Key Indicators

- Population: Approximately 8.8 million

- Average Wealth per Adult: USD 685,230

- Millionaire Density: Roughly 1 in 6 adults holds assets exceeding USD 1 million

Core Strengths

- Banking and Financial Expertise:

- Switzerland’s global reputation for wealth management is unparalleled.

- Institutions such as UBS and Credit Suisse, despite recent setbacks, maintain rigorous regulatory frameworks and innovative financial products that attract billions in foreign capital.

- Precision Industries and Luxury Exports:

- Swiss watchmaking (Rolex, Patek Philippe) and pharmaceutical manufacturing are benchmarks in quality and innovation.

- Investments in research and development ensure that these sectors remain competitive on a global scale.

- Insurance and Financial Services:

- A robust insurance sector underpins economic stability by underwriting significant corporate and private financial activities.

- These services mitigate risk and facilitate long-term investment strategies.

- Tourism, Infrastructure, and Quality of Life:

- Political stability, top-tier infrastructure, and pristine natural landscapes make Switzerland a preferred destination for high-net-worth individuals and institutional investors alike.

Challenges

- External Shocks:

Global supply chain disruptions and geopolitical tensions can affect Switzerland’s dependence on imported energy, particularly gas and oil. - Credit Suisse Crisis (2022):

The near-collapse of a major institution highlighted the systemic risks of banking concentration—even in a traditionally stable environment. - Rising Energy Costs:

Increasing global energy prices challenge the cost structures of Swiss industries, even as they maintain high profit margins.

3. China: Exponential Wealth Growth and Structural Real Estate Challenges

Economic Transformation

- Explosion in Millionaire Numbers:

The number of millionaires in China surged from 38,000 in 2010 to 4.4 million in 2019—a more than 100-fold increase—driven by rapid industrialization and an aggressive push into high-growth sectors. - Top 10% Wealth Segment:

Approximately 100 million Chinese individuals now belong to the global top 10% of wealth, a figure that challenges the traditional dominance of the United States (with roughly 99 million).

Growth Drivers

- Industrialization and Infrastructure Investment:

- Massive public and private investments in infrastructure, high-tech manufacturing, and digital innovation have accelerated wealth creation.

- Cultural Emphasis on Savings and Investment:

- A high national savings rate, combined with aggressive investments in real estate and stock markets, has fueled rapid asset accumulation.

- Technology and Consumer Markets:

- Leaders like Pony Ma (Tencent) and Robin Li (Baidu) exemplify the digital revolution that has redefined wealth creation in China.

Structural Crisis in Real Estate

- Record Losses:

The Chinese real estate market has seen a cumulative depreciation of USD 18 trillion over the past three years, dwarfing the losses observed during the 2008 U.S. financial crisis. - Key Structural Issues:

- Excessive Leverage:

Many property developers, such as those linked with Evergrande, have accumulated unsustainable debt levels to finance rapid expansion. - Asset Overvaluation:

Speculation and inflated pricing have created a bubble that now faces a severe correction. - Inadequate Policy Response:

Government measures have so far proved insufficient to counteract the deflationary pressures and restore investor confidence. - Demand Contraction:

Domestic and international demand has sharply contracted, further accelerating asset devaluation.

- Excessive Leverage:

Broader Implications

- Financial Stability Risks:

The collapse of property values poses significant risks to banks heavily exposed to real estate loans, potentially leading to broader financial contagion. - Geopolitical Shifts:

As China challenges established global financial centers, its structural vulnerabilities—particularly in real estate—may prompt shifts in capital flows and adjustments in international monetary policies.

Our technical analysis of global wealth distribution leads to several critical insights:

The concentration of global assets—where the top 1% controls nearly 50% of all wealth—has profound implications for market liquidity and risk management. With 46.8 million millionaires worldwide, capital remains highly centralized, influencing strategic investment decisions.

Switzerland’s unmatched average wealth per adult (USD 685,230) and a millionaire density of 1 in 6 highlight a system built on disciplined fiscal policy, sophisticated banking, and world-leading precision industries. Despite recent challenges like the Credit Suisse crisis and rising energy costs, the Swiss model remains a benchmark for stability and efficient capital management.

China’s meteoric rise—from 38,000 to 4.4 million millionaires and nearly 100 million people in the global top 10%—demonstrates the country’s ability to generate wealth quickly. However, the structural collapse in its real estate market (with losses of USD 18 trillion) exposes significant risks. This duality underscores a model reliant on aggressive leverage and speculation, raising questions about its long-term sustainability.

For investors and decision-makers, these insights emphasize the need to balance exposure between stable, proven models like Switzerland’s and high-growth, high-risk environments such as China’s. A comprehensive understanding of these nuanced dynamics is essential to optimize portfolio performance while mitigating potential systemic risks in an ever-evolving global economy.

Conclusion

USD 685,230 per Adult and USD 18 Trillion in Losses When Schweizer Exzellenz Defies the Global Order .Our in-depth analysis reveals three critical insights:

- Capital Concentration:

The fact that the top 1% controls nearly 50% of global assets, with 46.8 million millionaires worldwide, points to a highly concentrated distribution of wealth. For investors, this signals that the majority of capital is in the hands of a select few—a factor that can affect market liquidity and risk profiles. - The Swiss Model:

Switzerland’s average wealth of USD 685,230 per adult and a millionaire density of 1 in every 6 individuals demonstrate a robust and efficient financial system. Swiss banks, precision industries, and disciplined fiscal policies create a stable investment environment. Despite recent shocks—such as the Credit Suisse crisis and rising energy costs—the Swiss model remains a benchmark for stability and reliability in global capital markets. - China’s Rapid Transformation:

China’s explosive growth in wealth—from 38,000 millionaires in 2010 to 4.4 million in 2019, with roughly 100 million individuals in the global top 10%—shows its rapid capital formation. However, the real estate sector’s staggering depreciation of USD 18 trillion over three years exposes deep structural vulnerabilities due to excessive leverage and asset overvaluation. This presents a significant risk that could dampen further growth if not properly addressed.

These findings underscore the need for investors to adopt strategies that balance high returns with an acute awareness of systemic risks. The Swiss model exemplifies stability and efficiency, while China’s rapid expansion, despite its impressive numbers, carries inherent structural challenges that must be factored into any investment decision. Understanding these dynamics is essential for crafting informed, resilient investment strategies in a constantly evolving global market.